43 1120s other deductions worksheet

See Also: Form 1120 other deductions worksheet Show details Find the best 1120s Other Deduction Form, Find your favorite catalogs from the brands you love at daily-catalog.com. 2 hours ago Other Deductions Supporting Details For Form 1120 - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are Us 1120s line 19... Small Business Tax Deductions Worksheet (Part 1) Download your 2020 Small Business Tax Deductions Worksheet [PDF]. Parking and tolls — The IRS allows you to write-off business-related tolls and parking fees. The same tax provision allows you to deduct shipping of baggage, and sample or display material between your regular and temporary...

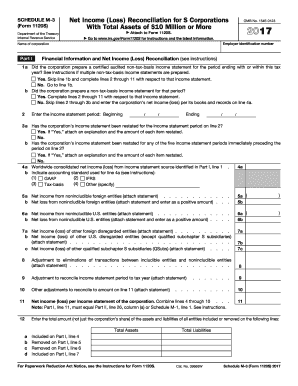

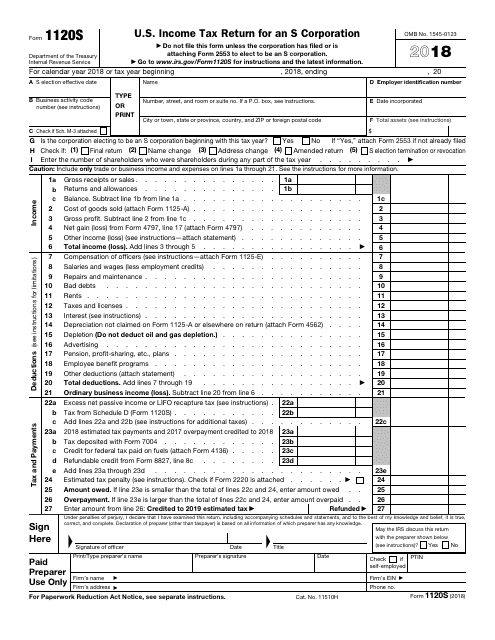

PDF LLC R eturns S Corporation Worksheet: The full S Corporation worksheet is necessary to calculate business cashflow and to determine an Other deductions (attach statement). See O* theSr TDMeduTctions Statement. Form 1120S (2011) Bailey's Fisheries Schedule B Other Information (see instructions).

1120s other deductions worksheet

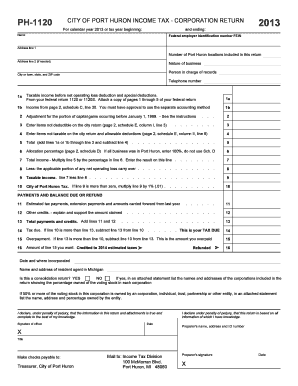

How to Calculate Labor on a Form 1120 | Small Business - Chron.com Other deductions can consist of many different types of expenses, depending on how your company keeps its accounts. Enter your results for employee labor costs on Line 13 of Form 1120. Enter your results for salaries and wages paid to corporate officers on Line 12. Where to Report Payment made to Independent Contractors on Form... Other Deductions - Line 19: If these fees do not fit any of these categories, you could record your payments to contractors on line 19 on Form 1120 S You add an attachment and narrate contactors' 1099 total amount or be more specific and group them by profession. For instance, deduct Legal and... 2011 1120s Other Deductions Worksheets - Lesson Worksheets Showing 8 worksheets for 2011 1120s Other Deductions. Worksheets are 1120s income tax return for an s corporation form, Drake software users manual, 1... Click on pop-out icon or print icon to worksheet to print or download.

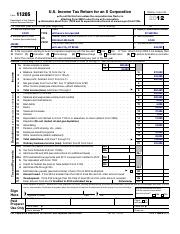

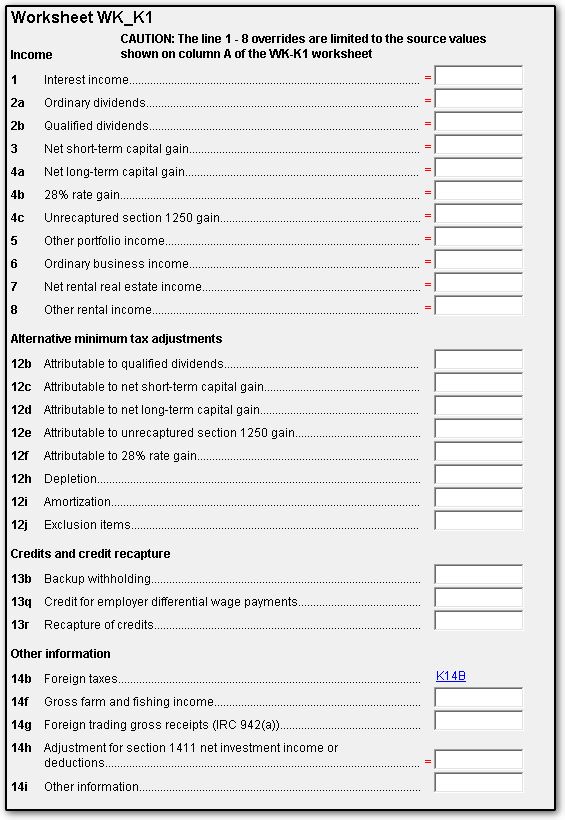

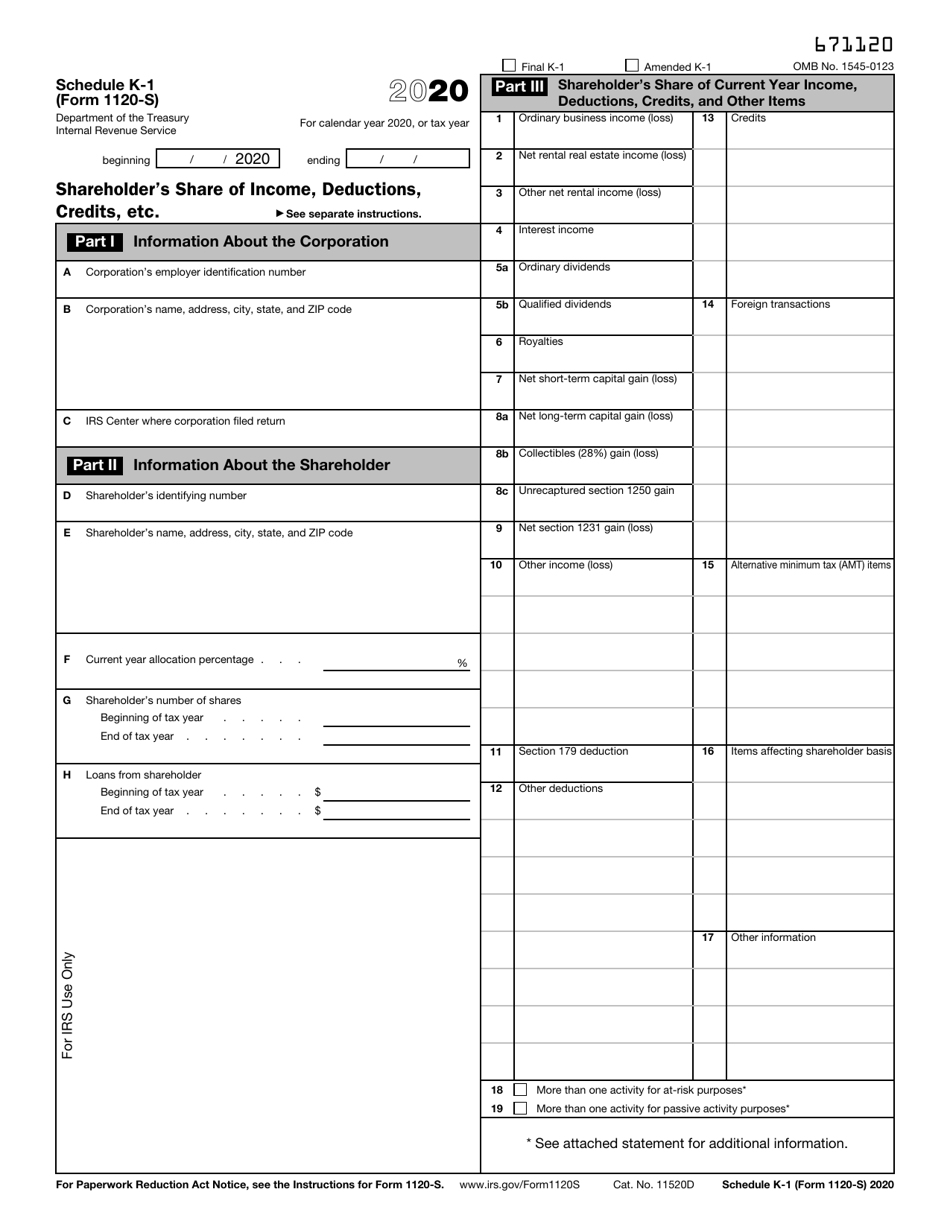

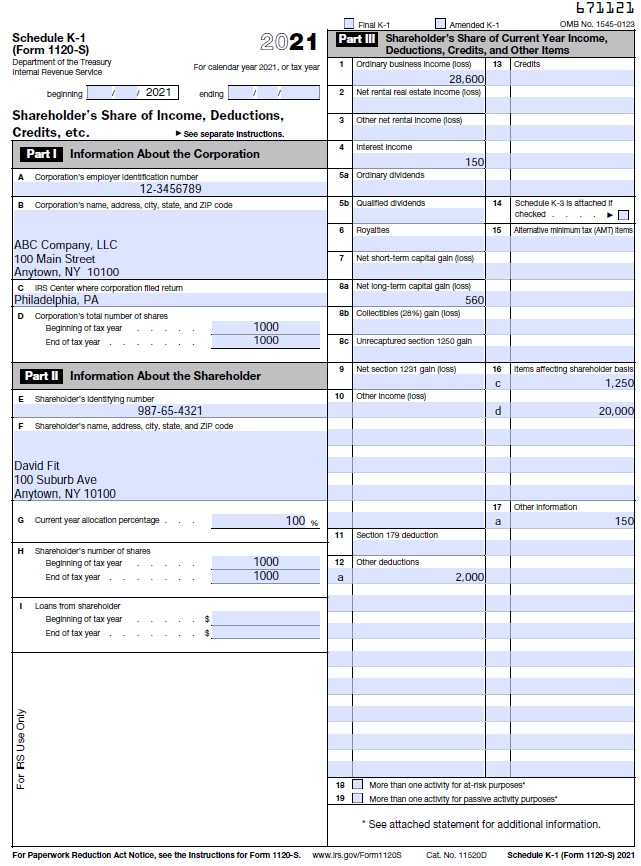

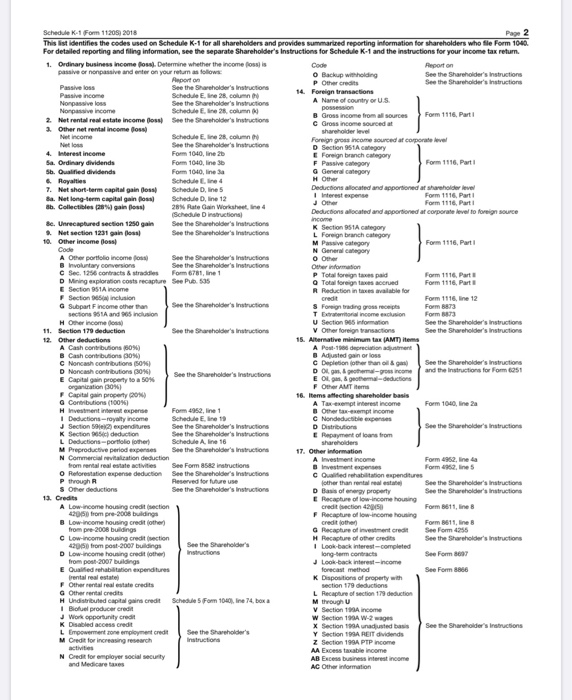

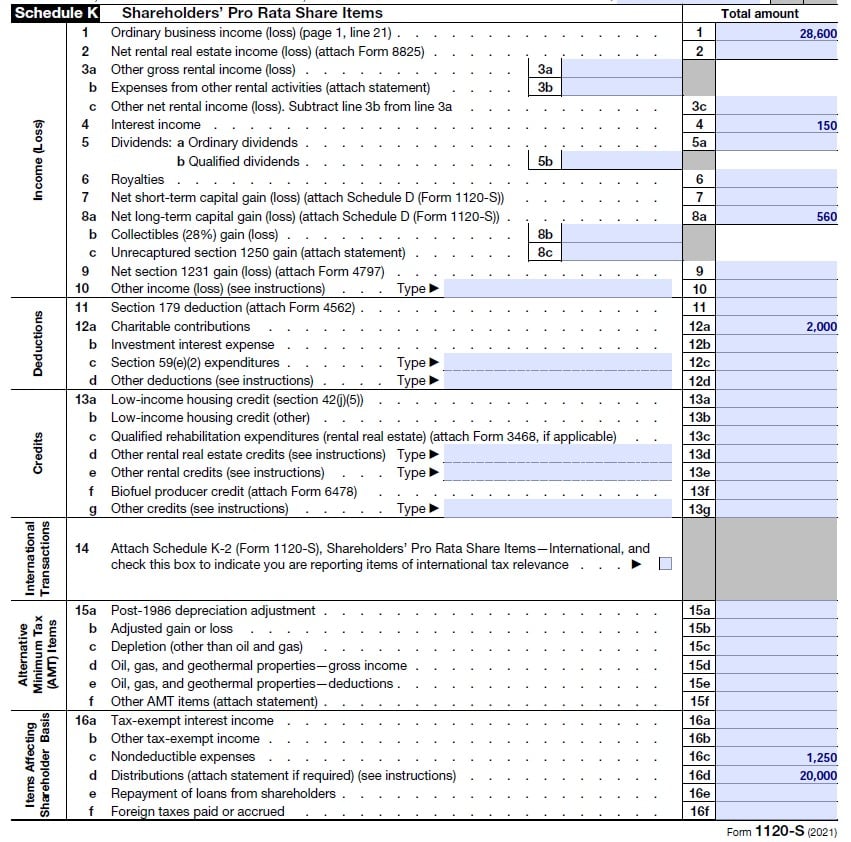

1120s other deductions worksheet. 2011 1120s Other Deductions Worksheets - Learny Kids Displaying top 8 worksheets found for - 2011 1120s Other Deductions. Some of the worksheets for this concept are 1120s income tax return for an s corporation form, Drake software users manual, 1120s income tax return for an s corporation form, Instructions for form 1120s, 1120s income tax... PDF HOWS Case Information - 09-01-19 H Other income (loss) 11 Section 179 deduction 12 Other deductions. A Cash contributions (60%) B Cash contributions (30%) C Noncash contributions (50%) D Noncash contributions (30%). 28% Rate Gain Worksheet, line 4 (Schedule D instructions) See the Shareholder's Instructions See the... US Internal Revenue Service: f1120ssk - 2005 | PDF | Tax Deduction 12 Other deductions For IRS Use Only. 17 Other information. * See attached statement for additional information. For Privacy Act and Paperwork Reduction Act Schedule K-1 (Form 1120S) 2005 Page 2. This list identifies the codes used on Schedule K-1 for all shareholders and provides summarized... Massachusetts Unemployment Deduction Worksheet | Mass.gov Massachusetts Unemployment Deduction Worksheet. You are eligible for this deduction if your household income is no more than 200% of the federal poverty level based on your household size. Use the worksheets below to calculate your household size and household income for tax year 2021.

Line 19 Other Deductions Worksheets - Teacher Worksheets Showing top 8 worksheets in the category - Line 19 Other Deductions. Some of the worksheets displayed are Us 1120s line 19, 1120s income tax return for an s corporation omb no, Supplemental work for tax year credit for taxes paid, Codes for other additions and other subtractions, Loan... Corporate Dividends Received Deduction Worksheet Use this worksheet to determine how much of your corporation's total dividends can be deducted from your federal taxable income. The Corporate Dividends Received Deduction (DRD) allows eligible U.S. corporations that receive dividends from other U.S. corporations to deduct 50% of the total U.S... How Do I Report the 1120-S Entries That Are Not Shown in the... Items that are not entered directly into 1120-S may need to be reported elsewhere in the program. Please review the information below for instructions for the boxes not included in the program. Please be aware that several entries may not be supported by the program at all at this time. 1120 Line 26 Other Deductions Worksheets - Learny Kids If the income, deductions, credits, or other information provided to any shareholder on Schedule K-1 is incorrect, file an amended Schedule K-1 (Form 1120-S) for that shareholder with the amended Form 1120-S. Listing Of Websites About 1120s other deductions worksheet. Share this

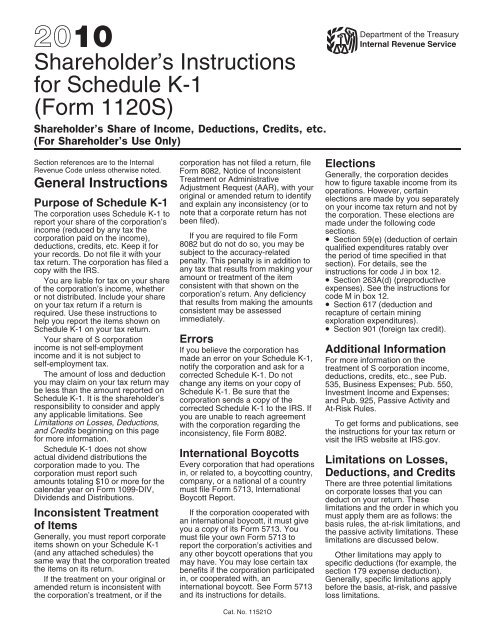

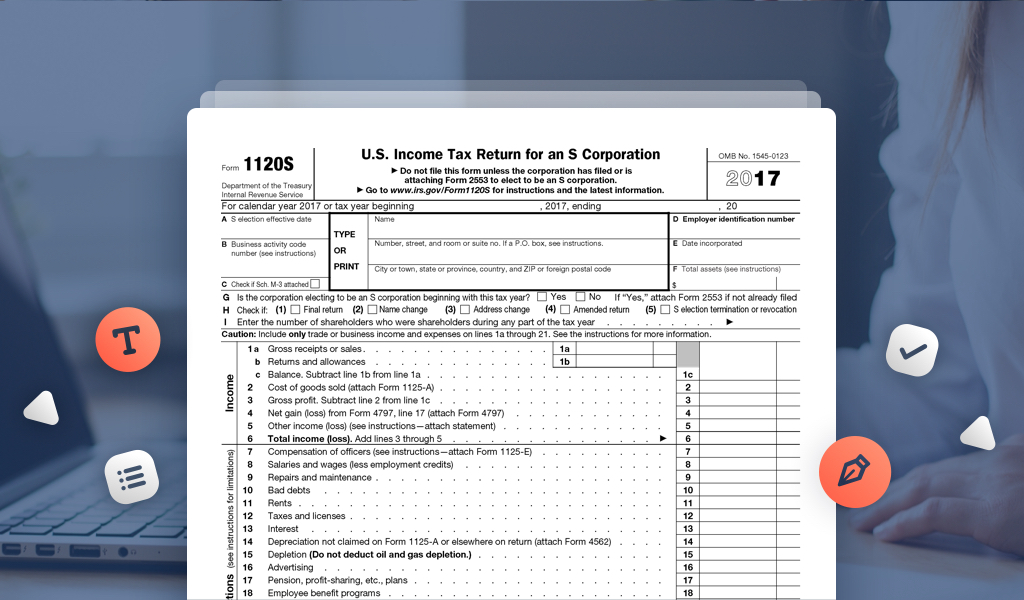

Instructions for Form 1120-S (2021) | Internal Revenue Service Deductions—Portfolio (other) (code L). Preproductive period expenses (code M). Schedule M-2 Worksheet. Column (b). Shareholders' Undistributed Taxable Income Previously Taxed. Use Form 1120-S to report the income, gains, losses, deductions, credits, and other information of a domestic... PDF 2011 Form 1120 S (Schedule K-1) % 11 Section 179 deduction 12 Other deductions. Schedule K-1 (Form 1120S) 2011. Page 2. This list identifies the codes used on Schedule K-1 for all shareholders and provides summarized reporting information for shareholders who. 28% Rate Gain Worksheet, line 4 (Schedule D instructions). 1120s Other Deductions Worksheet - Nidecmege 1120s other deductions displaying top 8 worksheets found for this concept. Use form 1120s to report the income gains losses deductions credits and other information of a domestic corporation or other entity for any tax year covered by an election to be an s corporation. PDF 2021 Shareholder's Instructions for Schedule K-1 (Form 1120-S) Other limitations may apply to specific deductions (for example, the section 179 expense deduction). Specific limitations generally apply before at-risk and passive loss limitations. 2. Rental real estate activities in which you materially participated if. Instructions for Schedule K-1 (Form 1120-S) (2021).

1120-US: Partner's Basis Worksheets FAQs Connect with other professionals in a trusted, secure, environment What losses and deductions are included in the basis limitation of the partner's share of partnership losses? Why does UltraTax/1120 combine Schedule K-1s received from the same partnership into one Partner's Basis Worksheet?

Other Deductions totals on an 2021 1120S - Intuit Accountants... : ProSeries Tax Discussions. : Other Deductions totals on an 2021 1120S. We have encountered what seems to be a problem on 2021 ProSeries in that the detailed total of the Other Deductions worksheet does not jive with the grand total that carries forward to the 1st page of the 1120S return.

Home Office Deduction Worksheet (Excel) Our sheet simplifies everything for you so you can be organized for tax season. Our worksheet assumes that you will be filing using the actual expense method because the simplified method bases the size of the home office deduction on the amount of space in your home that you are using as an...

1120S - Shareholders Adjusted Basis Worksheet (Basis Wks) (K1) Therefore, the basis worksheet in the 1120-S package is just an estimate of how the basis may be calculated at the individual level. Decreases to basis can include distributions of cash or property to shareholders, separately stated losses and deductions, nondeductible corporation expenses, and...

Deductions Worksheet Related Keywords & Suggestions... Deductions Worksheet. Calculating and Working please be patient. These are some of the images that we found within the public domain for your "Deductions Worksheet" keyword. These images will give you an idea of the kind of image(s) to place in your articles and wesbites.

Modals of Deduction online worksheet Live worksheets > English > English as a Second Language (ESL) > Modal verbs > Modals of Deduction. ID: 1309920 Language: English School subject: English as a Second Language (ESL) Grade/level: Senior 4 Age: 14+ Main content: Modal verbs Other contents: Tiempos verbales.

English ESL deduction worksheets - Most downloaded (19 Results) A collection of English ESL worksheets for home learning, online practice, distance learning and English classes to teach about deduction, deduction. Present simple vs continuous (progressive) tense. Pronouns: EACH OTHER, ONE ANOTHER (reciprocal pronouns).

PDF Us 1120s US 1120S. Line 19 - Other Deductions. Name: Type

1120s Other Deductions Worksheet | Printable Worksheets and... 1120s Other Deductions Worksheet The corporation must file form s to report its income and expenses 50 percent of adjusted gross income minus the deductions for all other charitable contributions you can carry unused Where do i put ppp forgiveness on s amounts reported line 7 of...

PDF Shareholder's Instructions Shareholder's Instructions for Schedule K-1 (Form 1120-S). Department of the Treasury Internal Revenue Service. Other limitations may apply to specific deductions (for example, the section Worksheet Instructions for Figuring a Shareholder's Stock and Debt Basis. Don't use this worksheet if.

1120 Other Deductions Worksheets - Kiddy Math 1120 Other Deductions - Displaying top 8 worksheets found for this concept. Some of the worksheets for this concept are Us 1120s line 19, 1120 s income tax return for an s corporation, 2019 instructions for form 1120 s, Tax deduction work, Income tax return for an s corporation omb 1545...

Other Deductions 2016 Worksheets - Printable Worksheets Other Deductions 2016 Worksheets - showing all 8 printables. Showing top 8 worksheets in the category - Other Deductions 2016 . Some of the worksheets displayed are Work a b and c these are work 2016 net, Deductions form 1040 itemized, 2016 w 4 planning work, 1120s income tax return...

2011 1120s Other Deductions Worksheets - Lesson Worksheets Showing 8 worksheets for 2011 1120s Other Deductions. Worksheets are 1120s income tax return for an s corporation form, Drake software users manual, 1... Click on pop-out icon or print icon to worksheet to print or download.

Where to Report Payment made to Independent Contractors on Form... Other Deductions - Line 19: If these fees do not fit any of these categories, you could record your payments to contractors on line 19 on Form 1120 S You add an attachment and narrate contactors' 1099 total amount or be more specific and group them by profession. For instance, deduct Legal and...

How to Calculate Labor on a Form 1120 | Small Business - Chron.com Other deductions can consist of many different types of expenses, depending on how your company keeps its accounts. Enter your results for employee labor costs on Line 13 of Form 1120. Enter your results for salaries and wages paid to corporate officers on Line 12.

0 Response to "43 1120s other deductions worksheet"

Post a Comment