39 non cash charitable contributions worksheet

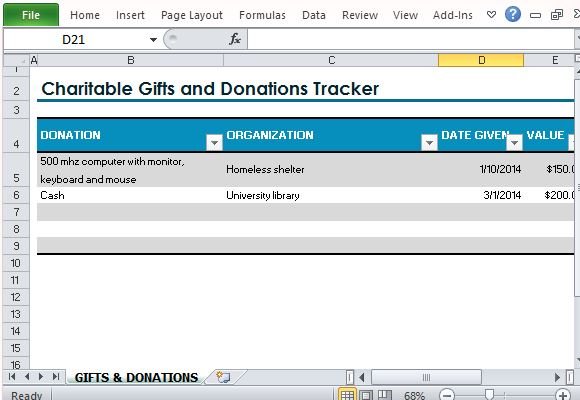

How to Determine Withholding Allowances ... 12-11-2021 · One deduction each for qualifying home mortgage interest, charitable contributions, state and local taxes up to $10,000, medical expenses of greater than 7.5% of the employee's income, student ... Charitable Contribution Worksheet | STAC Accounting Charitable Contribution Worksheet. Karen. December 20, 2017. Reporting Non Cash Charitable Donations can be extremely beneficial to your bottom line tax liability. Although, pulling it all together can also be painfully arduous. I am providing access to a worksheet built in excel. Download it and open in your 'sheets' app (excel, numbers ...

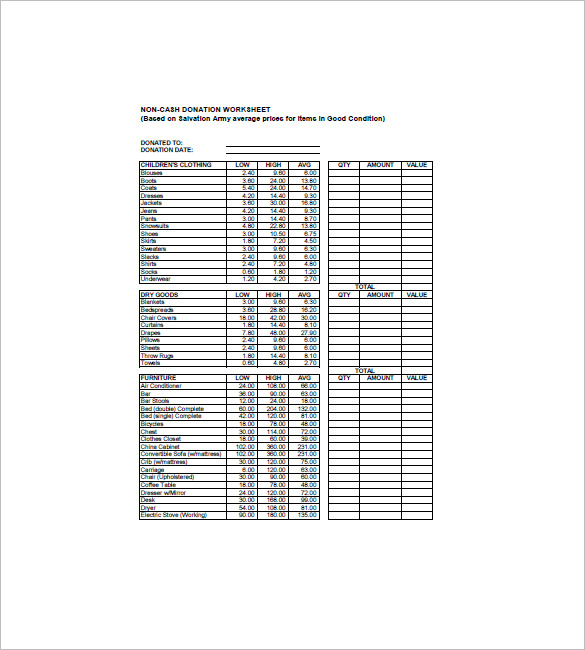

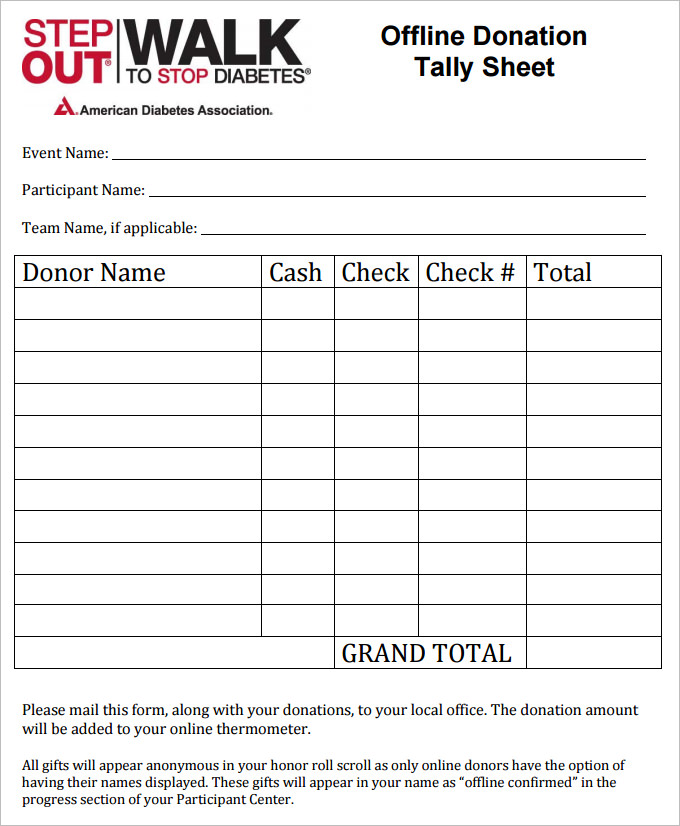

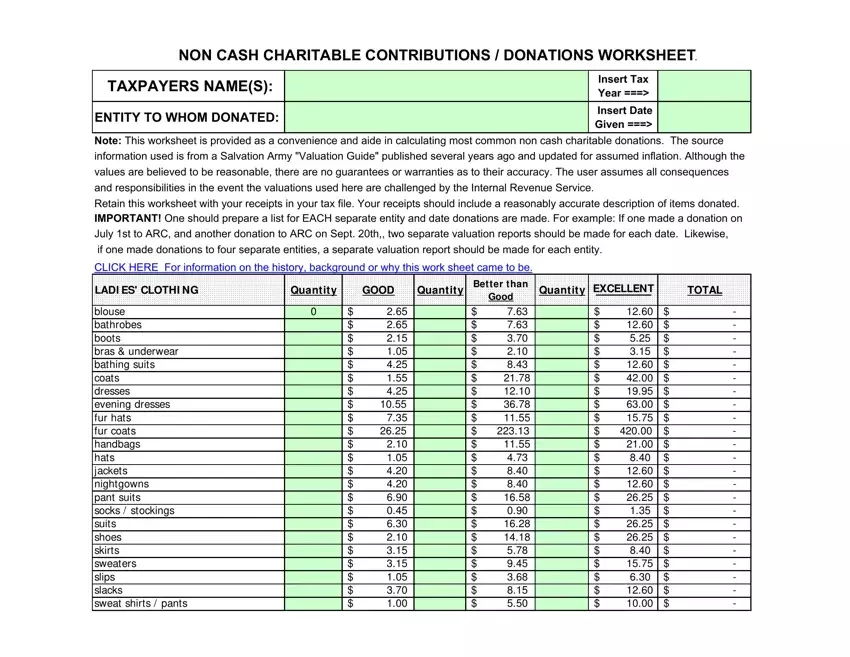

PDF Non Cash Charitable Contributions / Donations Worksheet the intent of this worksheet is to summarize your non-cash charitable contributions for the purpose of tax preparation and reporting. you the taxpayer, are responsible for maintaining an accurante and complete record of your non-cash charitable contributions. under tax regulations you acknowledge that you have

Non cash charitable contributions worksheet

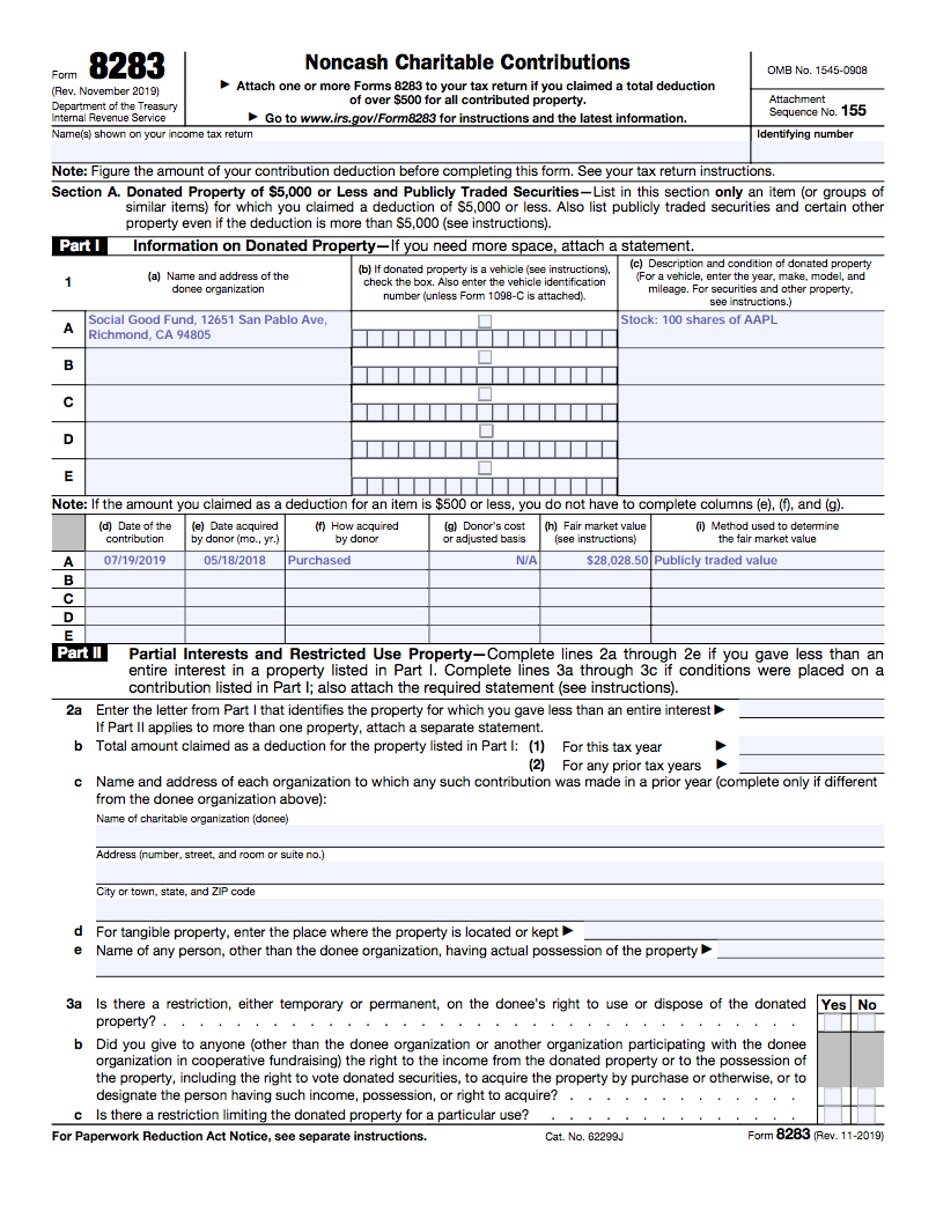

XLS Noncash charitable deductions worksheet. Noncash charitable deductions worksheet. 2011 LADIES' CLOTHING blouse bathrobes boots bathing suits coats dresses evening dresses fur hats fur coats handbags hats jackets nightgowns pant suits socks suits shoes skirts sweaters slips slacks MEN'S CLOTHING over coats pajamas pants - shorts raincoats shirts swim trunks tuxedo belts - ties Donation Calculator Use this donation calculator to find, calculate, as well as document the value of non-cash donations. You can look up clothing, household goods furniture and appliances. Using The Spreadsheet. If you are using a tablet or mobile device, you cannot enter any data. Publication 526 (2020), Charitable Contributions ... Noncash contributions. Total deduction over $500. Deduction over $5,000. Vehicle donations. Clothing and household items not in good used condition. Qualified appraisal. Qualified appraiser. Easement on building in historic district. Deduction over $500,000. Form 8282. How To Get Tax Help Preparing and filing your tax return.

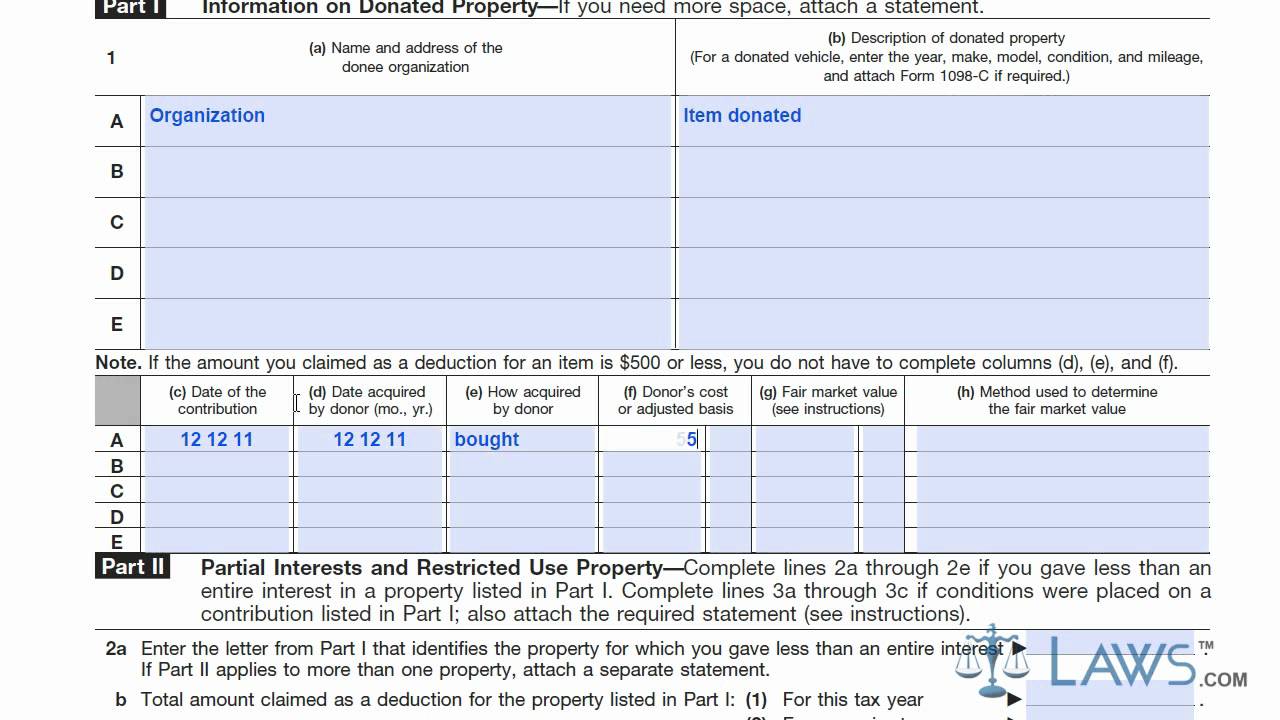

Non cash charitable contributions worksheet. XLSX Accounting and Tax Solutions, Inc. NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET. Insert Tax Year ===> WHAT IS YOUR ORIGINAL COST BASED ON RECIEPTS, OR YOUR BEST ESTIMATE, OF THE ITEMS DONATED? ... YOU MUST ALSO ATTACH THE RECEIPT TO THE WORKSHEET IN ORDER FOR IT TO BE ENTERED ON YOUR TAX RETURN. For "How Was it Acquired" please write either purchase, gift, or ... PDF Non-cash Charitable Contribution Worksheet non-cash charitable contribution worksheet date _____ organization _____ address_____ the following tables are estimates only. actual fmv may vary significantly. women's clothing qty amount qty amount subtotal XLS Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file. PDF Missing Information: Non-Cash Charitable Contributions ... Missing Information: Non-Cash Charitable Contributions Worksheet (pg 5) Prepared By: Kerry M. Kerstetter, CPA 01-21-2004 11802 Deer Road Harrison AR 72601-6550 Tel: (870) 553-2559 Fax: (870) 553-2599 Name: Tax Year: Home Telephone: Work Telephone: Fax: The following is a guideline for valuation of non-cash charitable contributions.

Tax Preparation Checklist [Updated for 2021-2022 ... 28-12-2021 · There’s a lot of information to gather and remember at the end of the year for you and your finances. We’ve put together a thorough Tax Preparation Checklist for Individuals for you to review and prepare to file your taxes.. Individuals can use this form as … PDF Missing Information: Non-Cash Charitable Contributions ... Missing Information: Non-Cash Charitable Contributions Worksheet (pg 4) Prepared By: HMS CERTIFIED PUBLIC ACCOUNTANTS 09-24-2013 457 Lake Howell Rd. Maitland FL 32751 Tel: (407) 571-4080 Fax: (407) 571-4090 information@hmscpa.com Men's Clothing $$ Guideline Your Cost # Items Value Today Deduction Jackets 7.50 - 25.00 Overcoats 15.00 - 60.00 About Form 8283, Noncash Charitable Contributions ... About Form 8283, Noncash Charitable Contributions Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500. Current Revision Form 8283 PDF Instructions for Form 8283 (Print Version) PDF Recent Developments Top Tax Deductions for Etsy Sellers - Article - QuickBooks 08-02-2017 · If you’re using your car to pick up or drop off packages, you can deduct your vehicle expenses. There are two different methods to calculate your business mileage deductions, so choose the way you’ll get the most money back.The first method — the standard deduction — is a flat 54.5 cents per mile driven for business purposes.

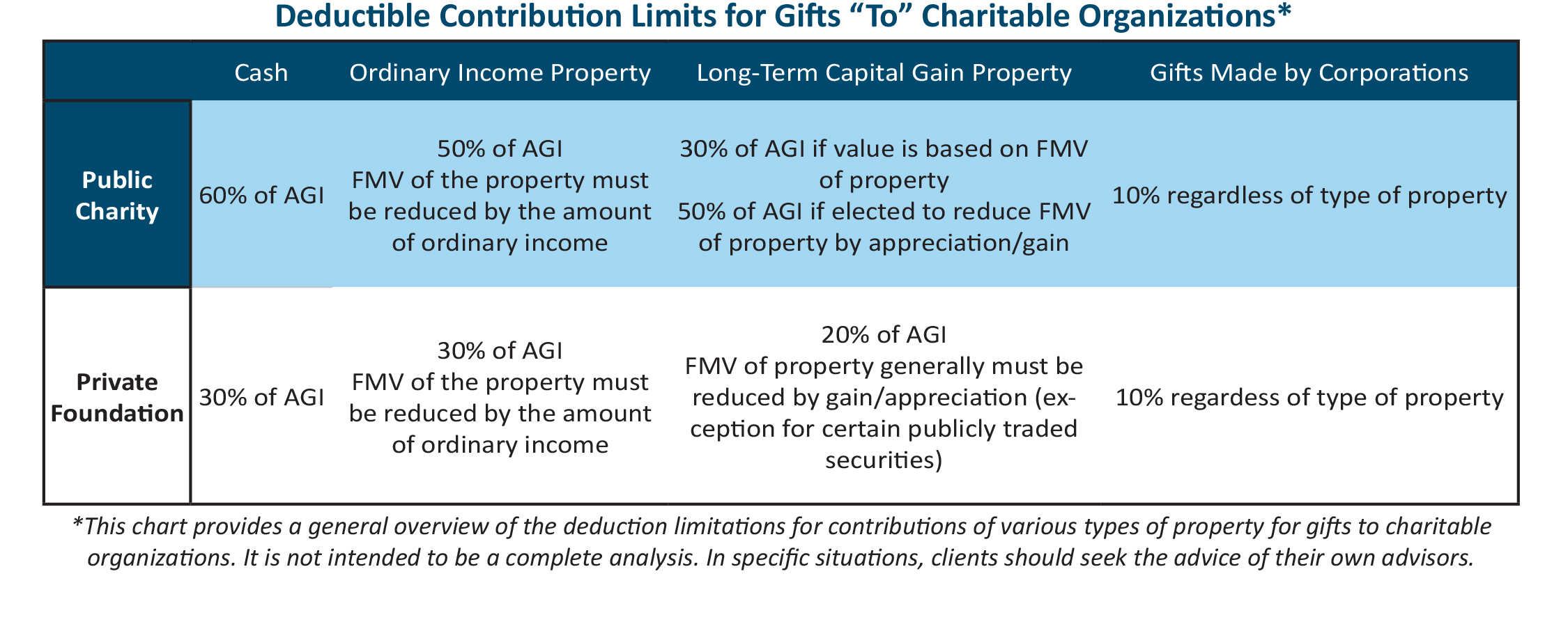

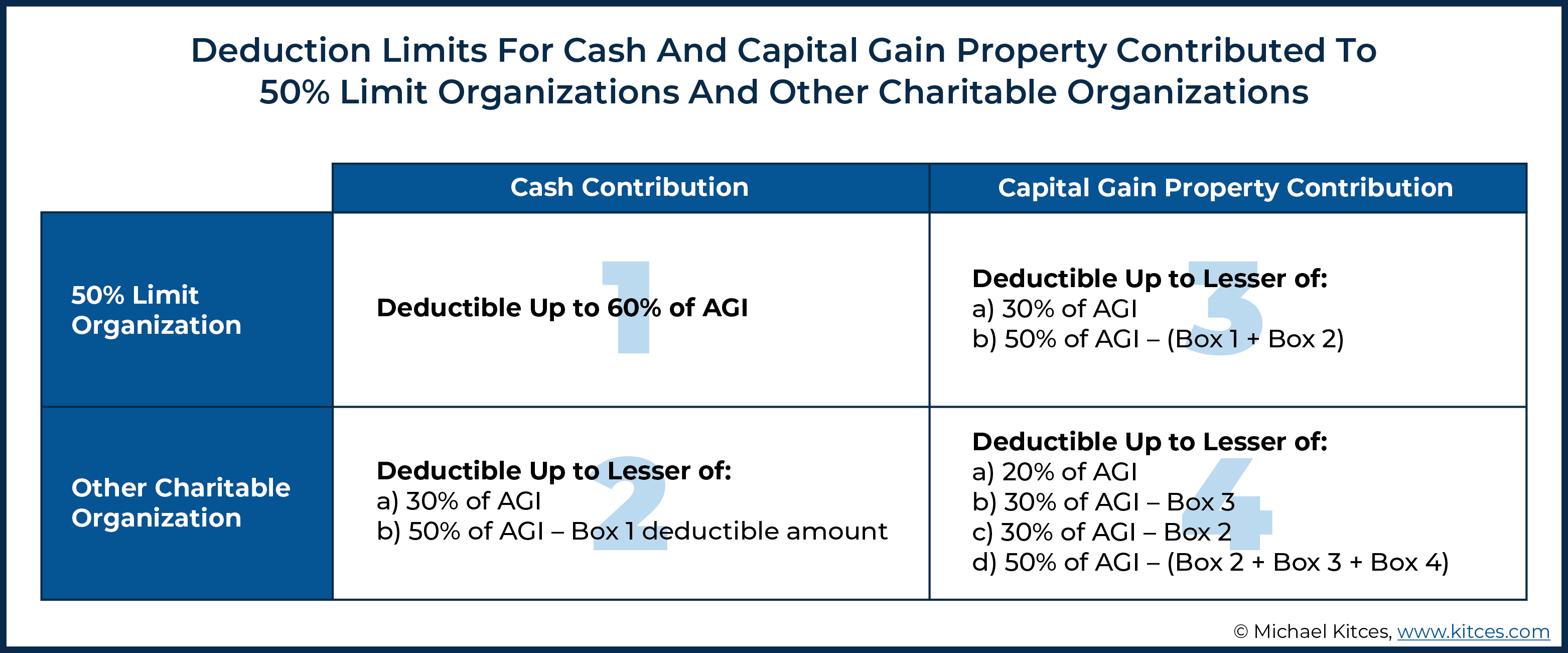

PDF NON-CASH DONATION WORKSHEET (Based on Salvation Army ... NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: LADIE'S CLOTHING LOW HIGH AVG QTY AMOUNT VALUE Blouse 3.00 14.40 8.70 Bathrobe 3.00 14.40 8.70 Boots 2.40 6.00 4.20 Bras 1.20 3.60 2.40 Bathing Suits 4.80 14.40 9.60 PDF Non Cash Charitable Contribution - Boelman Shaw * PLEASE NOTE:This worksheet is provided as an aid to help you in calculating deductions of the most common non-cash charitable donations. Values indicated are based on the Salvation Army's web site's as of 07/01/15. PDF Non-Cash Charitable Contributions Worksheet - LB Tax Services Missing Information: Non-Cash Charitable Contributions Worksheet Name. Home Telephone: Work Telephone: Tax Year: 2016 Cell: The following is a guideline for valuation of non-cash charitable contributions. When valuing items, take into consideration the condition of the items. If the value of the donated items is $250 or more to one charity in Tax Help & Support - TaxAct Cash Contributions Limitations Worksheet Casualty and Theft - Reimbursement Less Than Expected or Reported Charitable - Desktop and Professional Editions - Detailed Information Dialog Box Limited to 250 Entries

XLS Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the

XLS Noncash charitable deductions worksheet. Noncash charitable deductions worksheet. NonCash Recap MEN'S CLOTHING CHILDREN'S CLOTHING Quantity GOOD EXCELLENT TOTAL TOTAL OF ALL DONATED ITEMS ENTITY TO WHOM DONATED: MY / OUR BEST GUESS OF VALUE NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET. Insert Tax Year ===> Insert Date Given ===>

PDF Non-cash Charitable Contributions / Donations Worksheet NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET TAXPAYERS NAME(S): Insert Tax Year ===> ENTITY TO WHOM DONATED: Insert Date Given ===> Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations.The source

Publication 525 (2021), Taxable and Nontaxable Income ... A charitable organization to which contributions are deductible is the only beneficiary of the policy for the entire period the insurance is in force during the tax year. (You aren’t entitled to a deduction for a charitable contribution for naming a charitable organization as …

PDF 8283 Worksheet - Noncash Charitable Contributions 8283 Worksheet - Noncash Charitable Contributions (for donated vehicle, enter VIN, year, make, model, condition & mileage - Form 1098-C required if over $500) Description of donated property Information on Donated Property Taxpayer Name _____ Tax Year _____ Rev 01/2020. Created Date: 1/29/2020 5:23:59 PM ...

PDF 2020 Charitable Contributions Noncash FMV Guide Charitable contributions of property in excess of $5,000. Planning Tip: Most cell phones today can take pictures. Take a picture of all items donated. Keep the electronic pictures for proof the items were in good or better con-dition at the time they were donated. Recordkeeping Rules for Charitable Contributions

Your favorite homework help service - Achiever Essays ALL YOUR PAPER NEEDS COVERED 24/7. No matter what kind of academic paper you need, it is simple and affordable to place your order with Achiever Essays.

XLSX John Lebbs CPA, PLLC Non Cash Charitable Contributions Worksheet - Excel Version Author: Heather Murphy-Walker Last modified by: Aaron Kimball Created Date: 7/16/2014 8:56:26 PM Other titles: Sheet1 Sheet2 Sheet3 Sheet1!Print_Area

Claiming A Charitable Donation Without A Receipt | H&R Block If claiming a deduction for a charitable donation without a receipt, you can only include cash donations, not property donations, of less than $250. And, you must provide a bank record or a payroll-deduction record to claim the tax deduction. You need a receipt and other proof for both of these: Cash donations of $250 or more; Non-cash donations

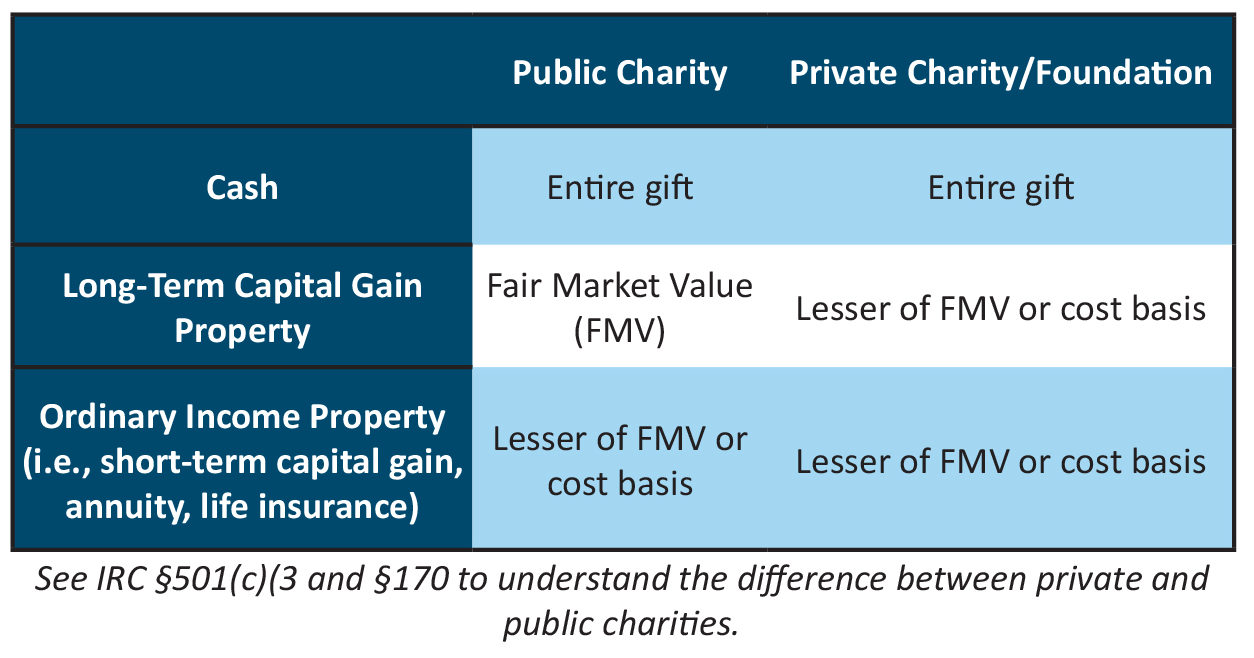

PDF Tax e-form Non-Cash Charitable Contribution Worksheet GUIDELINES FOR DEDUCTING NON-CASH CHARITABLE CONTRIBUTIONS If you donated a single item or a group of similar items, other than publicly traded securities, that you value at over $5,000, you cannot use this worksheet -- a signed Declaration of Appraiser must be obtained for donations valued at over $5,000.

Nonprofit Hospitals' Community Benefit ... - Health Affairs 25-02-2016 · The Congressional Budget Office estimated that the value of federal, state, and local tax exemptions, tax-deductibility of charitable contributions, and …

Publication 526 (2020), Charitable Contributions ... Noncash contributions. Total deduction over $500. Deduction over $5,000. Vehicle donations. Clothing and household items not in good used condition. Qualified appraisal. Qualified appraiser. Easement on building in historic district. Deduction over $500,000. Form 8282. How To Get Tax Help Preparing and filing your tax return.

Donation Calculator Use this donation calculator to find, calculate, as well as document the value of non-cash donations. You can look up clothing, household goods furniture and appliances. Using The Spreadsheet. If you are using a tablet or mobile device, you cannot enter any data.

XLS Noncash charitable deductions worksheet. Noncash charitable deductions worksheet. 2011 LADIES' CLOTHING blouse bathrobes boots bathing suits coats dresses evening dresses fur hats fur coats handbags hats jackets nightgowns pant suits socks suits shoes skirts sweaters slips slacks MEN'S CLOTHING over coats pajamas pants - shorts raincoats shirts swim trunks tuxedo belts - ties

0 Response to "39 non cash charitable contributions worksheet"

Post a Comment