43 mortgage insurance premiums deduction worksheet

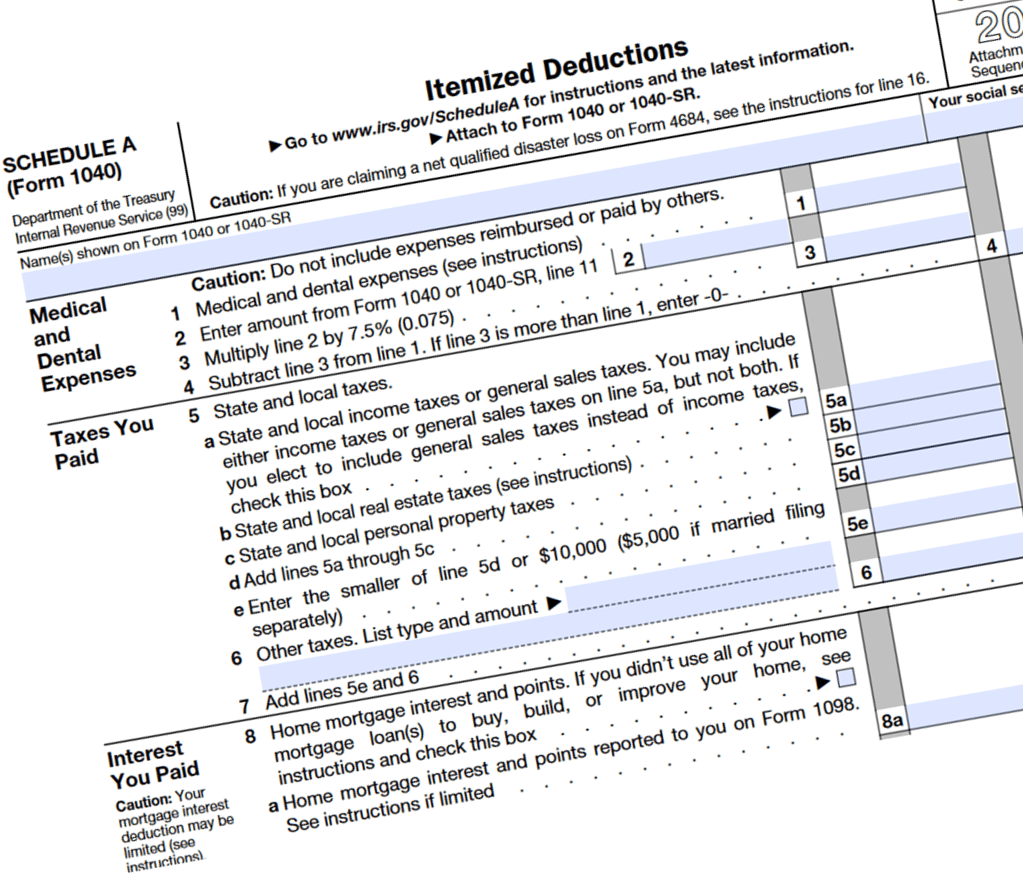

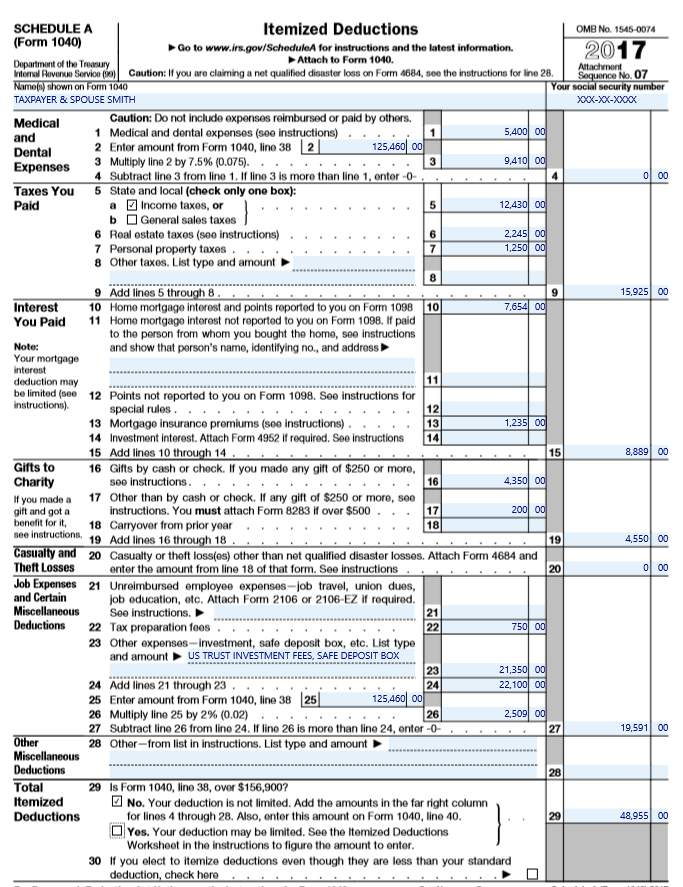

Learn About Mortgage Insurance Premium Tax Deduction. Learn About the Mortgage Insurance Premium Tax Deduction. Mortgage insurance premiums can increase your monthly budget significantly—an additional $83 a month or so at a 0.5% rate on a $200,000 mortgage. Publication 530 (2021), Tax Information for Homeowners ... See Line 8d in the Instructions for Schedule A (Form 1040) and complete the Mortgage Insurance Premiums Deduction Worksheet to figure the amount you can deduct. If your adjusted gross income is more than $109,000 ($54,500 if married filing separately), you can't deduct your mortgage insurance premiums.

PDF 2019 Publication 527 | Reporting Income and Deductions Mortgage insurance premiums. Recent leg-islation extended to 2019 (and retroactively to 2018) the deduction for mortgage insurance premiums. See Worksheet 5-1, later in this.

Mortgage insurance premiums deduction worksheet

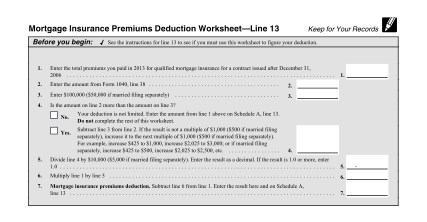

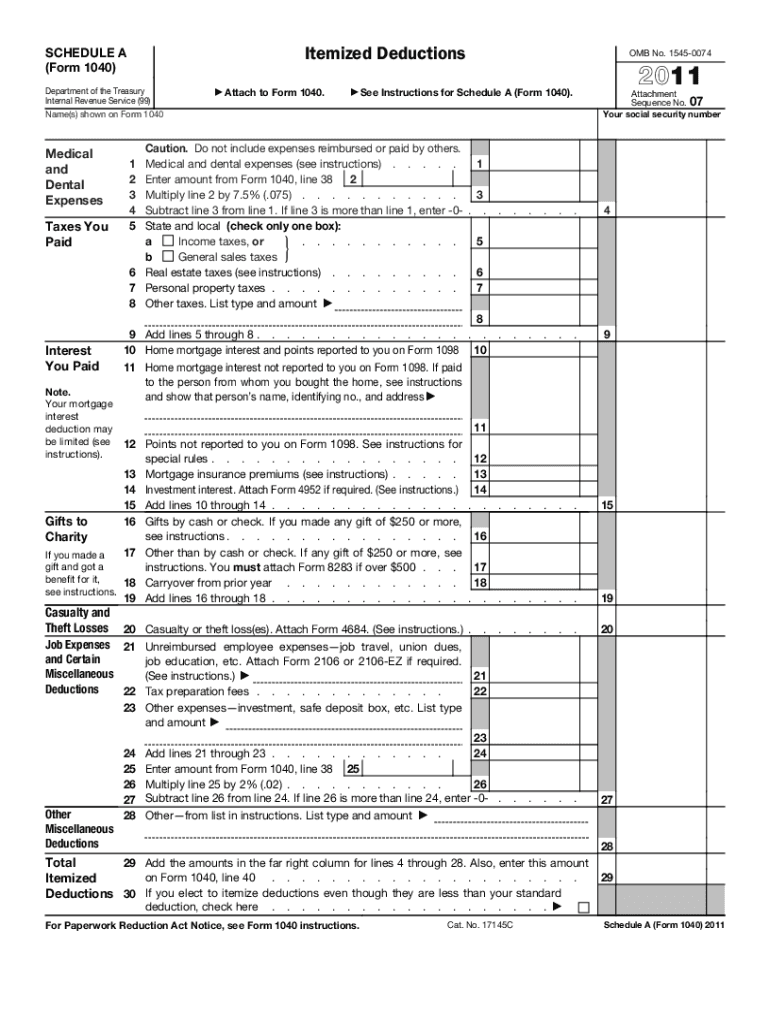

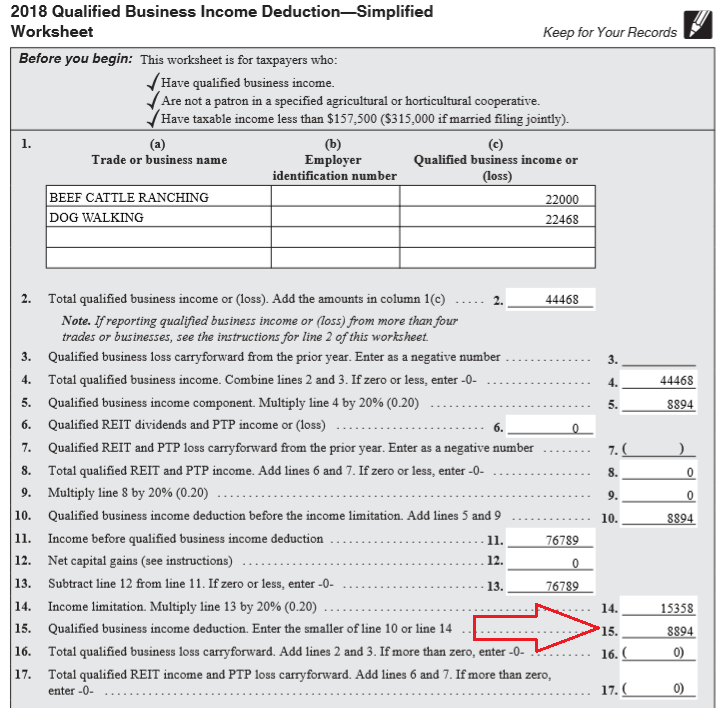

Schedule A – Itemized Deductions - IRS tax forms Select for mortgage interest reported on Form 1098. Enter amount from Form 1098F, box 1 (and box 2, if applicable). See Tab EXT, Legislative Extenders for Private Mortgage Insurance (if extended) Note: The deduction for home equity debt is dis-allowed as a mortgage interest deduction unless the home equity debt was used to build, buy, or Qualified Mortgage Insurance Premiums - No Longer Deductible See Prepaid mortgage insurance premiums, later, if you paid any premiums allocable to any You can't deduct your mortgage insurance premiums if the amount on Form 1040, line 38 is limited and you must use the Mortgage Insurance Premiums Deduction Worksheet to figure your deduction. Screen A - Itemized Deductions (1040) Used to complete the Medical Insurance Worksheet, Worksheet 1 - Self-Employed Persons. However, UltraTax CS cannot limit the deduction for dependents if the data is entered for multiple activities. Prior Amort: Enter the previously-deducted mortgage insurance premiums in this field.

Mortgage insurance premiums deduction worksheet. Is mortgage insurance tax deductible? The tax deduction for PMI premiums (or Mortgage Insurance Premiums (MIP) for FHA-backed loans) is not part of the tax code, but since the financial crisis You can find the amount of mortgage insurance premiums you paid on the Form 1098 that your lender or servicer sends to you each year. Can I deduct mortgage insurance premiums? You are no longer able to deduct mortgage insurance premiums (PMI). The deduction for mortgage insurance premiums has expired and was not renewed by Congress. 2019 Instructions for Form 8829 | Who Can Deduct Expenses for Mortgage insurance premiums reported on Schedule A. When you figure your itemized deduction for mortgage insurance premiums on Schedule A, use only the personal portion of your mortgage insurance premiums when completing the Mortgage Insurance Premiums Deduction Worksheet... Free File Supported Federal Forms Mortgage Insurance Premiums Deduction Worksheet. Business use of your home (Simplified Method Worksheet). Worksheet for Lump-Sum Distributions. Worksheet for Home Mortgage Interest. Worldwide Qualified Dividends and Capital Gains.

Commercial Activity Tax (CAT) Insurance companies that pay the insurance premiums tax, Certain affiliates of financial institutions, and ; Businesses with less than $150,000 of taxable gross receipts (unless they are part of a “consolidated elected taxpayer” or “combined taxpayer”). Beginning in 2014, excluded from the CAT are: Non-profit organizations, Mortgage Insurance Premiums Deduction Worksheet - Nidecmege Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 a month or so at a 5 percent rate on a 200000 mortgage as of 2018. You may be able to deduct mortgage interest only on the first 750000 375000 if married fil ing separately of indebtedness. Top 12 Rental Property Tax Deductions & Benefits [+ Free Worksheet] 6. Can You Deduct Mortgage From Rental Income? One of the best tax benefits of rental property is the interest tax deduction. In addition, investors can deduct the property tax and the property insurance that may be part of the mortgage payment. However, the entire mortgage payment... Publication 535 (2020), Business Expenses | Internal ... Self-Employed Health Insurance Deduction. Qualified long-term care insurance. Qualified long-term care insurance contract. Qualified long-term care services. Worksheet 6-A. Self-Employed Health Insurance Deduction Worksheet; Chronically ill individual. Benefits received. Other coverage. Effect on itemized deductions. Effect on self-employment tax.

Origins of Mortgage Insurance Tax Deduction If certain requirements were met, mortgage insurance premiums could be deducted as an itemized deduction on your return. If your adjusted gross income (AGI) is $109,000 or more for the year, this deduction is not allowed. This also holds true for married people filing separately... Mortgage Insurance Premiums Deduction Worksheet Free Printables Worksheet. Mortgage Insurance Premiums Deduction Worksheet. Worksheets For Pre K, Letter Z Worksheets For Pre K, Worksheet Templates Word, Worksheet Template Excel, Worksheet Template Latex, Worksheet Template Indesign, Worksheet Template Doc Is Private Mortgage Insurance (PMI) Tax Deductible? Private mortgage insurance helps protect the lender if you suddenly lose your job or other unforeseen issues arise where you can't make your mortgage Understandably, you'd like to be able to deduct your PMI to take some of the stress and strain out of paying your premiums. To know if your PMI is... Montana — Standard Deduction, Qualified Mortgage Insurance... ...Deduction, Qualified Mortgage Insurance Premiums Deduction and Itemized Deduction We last updated Montana Form 2 Worksheet V and IV in March 2021 from the Montana Department of Disclaimer: While we do our best to keep Form 2 Worksheet V and IV up to date and complete on...

Worksheet V And Vi - Standard Deduction And Qualified Mortgage... Worksheet VI - Qualified Mortgage Insurance Premiums Deduction. If you have completed the Qualified Mortgage Insurance Premiums Deduction Worksheet for your federal return, you do not need to complete this worksheet.

How to Deduct Your Upfront Mortgage Insurance Premiums The upfront mortgage insurance premium deduction has expired, which An upfront mortgage insurance payment is different than monthly payments for mortgage insurance. Use the worksheet that comes with Schedule A to see how much you can deduct. Got a VA or Rural Housing Loan?

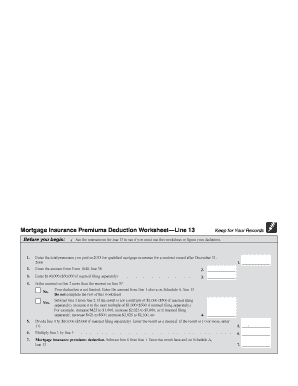

PDF 2020 Instructions for Schedule A | Mortgage Insurance Premiums Mortgage Insurance Premiums Deduction Worksheet—Line 8d. Keep for Your Records. Before you begin: See the instructions for line 8d to see if you must use this worksheet to figure your deduction. 1. Enter the total premiums you paid in 2020 for qualified mortgage insurance for a contract issued...

When is PMI Tax Deductible? | NextAdvisor with TIME The federal tax deduction for PMI is available for the 2020 tax year, if you meet certain You may be able to deduct thousands of dollars a year in private mortgage insurance , or PMI, fees from your taxes. If you itemize your tax deductions, then you'll want to claim your PMI premiums if you can.

PDF WCG Deductions Worksheet | Health Insurance Premiums 2021 Deductions Worksheet Copyright© 2021 WCG Inc. Page 3 of 10. Premium Tax Credit. The IRS allows the mortgage interest deduction for a loan that is not in your name as long as you have an. interest in the property associated with the loan either through legal (as in title) or equity.

What Is the Mortgage Insurance Premium Deduction? | Millionacres Can you use the mortgage insurance premium deduction? Just because you paid PMI or another type of mortgage insurance doesn't necessarily mean you can deduct it on your taxes. In order to deduct your qualified mortgage insurance, two things need to be true.

2021 Publication 936 - Internal Revenue Service Mortgage Insurance Premiums. Form 1098, Mortgage Interest Statement. How To Report. Special Rule for Tenant-Stockholders in Cooperative Housing Part II explains how your deduction for home mortgage interest may be limited. It contains Table 1, which is a worksheet you can use to figure the...

Deducting Mortgage Insurance Premiums as Mortgage Interest... Can mortgage insurance premiums be deducted from income taxes as mortgage interest deduction? You can treat amounts you paid during 2019 for qualified mortgage insurance as home mortgage interest. The insurance must be in connection with home acquisition debt, and the...

Tax Forms | IRS Tax Forms - Bankrate.com Dec 12, 2017 · Get IRS tax forms and publications at Bankrate.com. Tax forms for individuals - 1040, 1040EZ, W-2. Tax forms for business - 940, Schedule C-EZ.

Itemized Deductions (Tax course) Flashcards | Quizlet Line 13 - Mortgage Insurance Premium Use the mortgage insurance premium worksheet to calculate the deductible portion of the mortgage insurance premium. Qualified mortgage insurance premiums are paid under a mortgage insurance contract issued after December 31, 2006...

Part 2 | Your standard deduction is Points. Mortgage Insurance Premiums. Form 1098, Mortgage Interest Statement. Standard Deduction Worksheet for Dependents. Use this worksheet only if someone else can claim you (or Medical expenses include the premiums you pay for insurance that covers the expenses of medical...

It's Back - Deduction for Mortgage Insurance Premiums Either as mortgage insurance premium (MIP) provided by the Department of Veterans Affairs, the Federal Housing Administration, or the Rural Housing Services, or as private mortgage insurance (PMI). Keep in mind that income caps and ability to itemize your deductions may limit or eliminate...

Mortgage Insurance Premium Deduction Retroactively Extended This mortgage insurance premium deduction has been retroactively extended back to 2018 and through 2020. If you paid premiums for mortgage insurance in 2018 or were amortizing prepaid mortgage insurance premiums from an earlier year's home purchase...

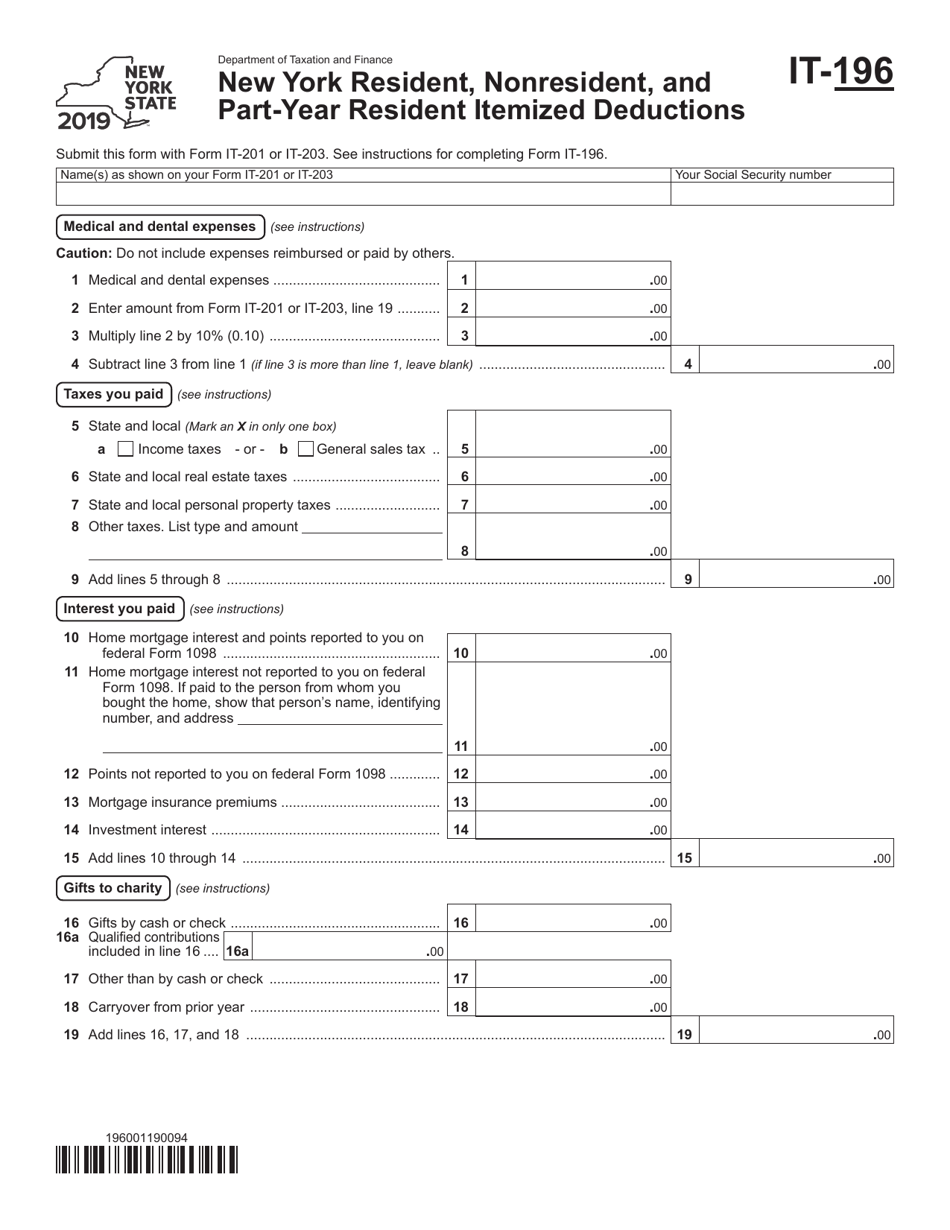

Instructions for Form IT-196 - Tax.ny.gov Note: The deduction for mortgage insurance premiums allowed ... Theft Worksheet for Special instructions for completing Form 4684.24 pages

PDF 2019 Instructions for Virginia Schedule A Itemized Deductions One extender deals with the treatment of qualified mortgage insurance premiums as interest for purposes of the mortgage interest deduction. If you have an addition (Schedule ADJ, Line 2a) or subtraction (Schedule ADJ, Line 6a) for Fixed Date Conformity, refer to the FDC Worksheet to...

A Complete List of Itemized Deductions to Consider for 2021 tax returns Use the Mortgage Insurance Premiums Deduction Worksheet from the IRS Instructions for Schedule A if you want help calculating this total deduction. The miscellaneous itemized deductions available include gambling losses, impairment-related work expenses of a disabled person, and amortizable...

Standard Deduction, Qualified Mortgage Insurance Premiums... *Obsolete, see form 2 instructions Form 2 Worksheet V and IV requires you to list multiple forms of income, such as wages, interest, or alimony . We last updated the Standard Deduction, Qualified Mortgage Insurance Premiums Deduction and Itemized Deduction Limitation (OBSOLETE) in...

Is There a Mortgage Insurance Premium Tax Deduction? The Mortgage Insurance Tax Deduction Act of 2017 was introduced in Congress to make the mortgage insurance tax deduction permanent, but it was never passed into Whether you qualify for a mortgage insurance premium deduction will depend on a number of factors (listed below).

2019 Qualified Mortgage Insurance Premiums Deduction ... Enter the total premiums you paid in 2019 for qualified mortgage insurance for a contract entered into on or after January 1, 2007 .1 page

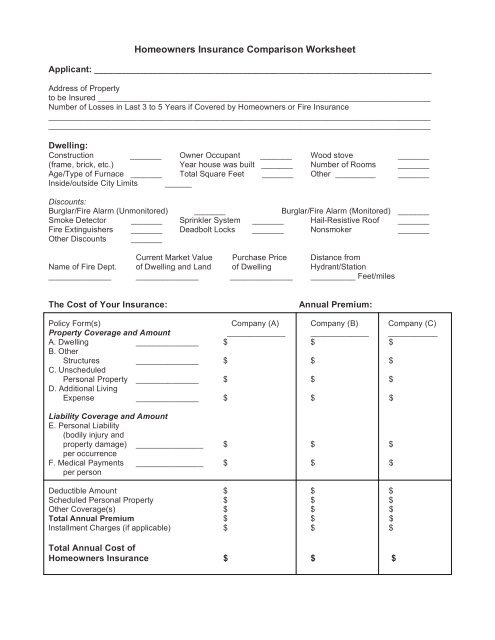

Can You Claim the Home Office Deduction in 2022 ... Dec 03, 2021 · Homeowners insurance. Mortgage interest (also look into the mortgage interest deduction) Mortgage insurance premiums, including PMI. Property taxes, which the IRS calls real estate taxes. Condominium fees and homeowners association fees. Depreciation of your home, if you own it (see IRS instructions for Form 8829 to learn more)

How does a refinance in 2021 affect your taxes? - HSH.com Jan 05, 2022 · Congress originally allowed homeowners to deduct mortgage insurance as part of the Mortgage Forgiveness Debt Relief Act of 2007. As the deductibility of mortgage insurance premiums isn't a permanent part of the tax code, the ability to deduct them relies on routine reauthorization by Congress, and there is no guarantee that they will do so.

Screen A - Itemized Deductions (1040) Used to complete the Medical Insurance Worksheet, Worksheet 1 - Self-Employed Persons. However, UltraTax CS cannot limit the deduction for dependents if the data is entered for multiple activities. Prior Amort: Enter the previously-deducted mortgage insurance premiums in this field.

Qualified Mortgage Insurance Premiums - No Longer Deductible See Prepaid mortgage insurance premiums, later, if you paid any premiums allocable to any You can't deduct your mortgage insurance premiums if the amount on Form 1040, line 38 is limited and you must use the Mortgage Insurance Premiums Deduction Worksheet to figure your deduction.

Schedule A – Itemized Deductions - IRS tax forms Select for mortgage interest reported on Form 1098. Enter amount from Form 1098F, box 1 (and box 2, if applicable). See Tab EXT, Legislative Extenders for Private Mortgage Insurance (if extended) Note: The deduction for home equity debt is dis-allowed as a mortgage interest deduction unless the home equity debt was used to build, buy, or

0 Response to "43 mortgage insurance premiums deduction worksheet"

Post a Comment