40 2015 qualified dividends and capital gain tax worksheet

PDF Qualified Dividends and Capital Gain Tax Worksheet -Line ... See the instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. Qualified Dividends And Capital Gain Tax Worksheet 2021 ... 2020 qualified dividends and capital gain tax worksheetreate electronic signatures for signing a qualified dividends and capital gain tax worksheet 2021 in PDF format. signNow has paid close attention to iOS users and developed an application just for them.

Capital Gain Tax Worksheet - Diy Color Burst Qualified Dividends and Capital Gain Tax Worksheet. The positive gain here is equal to the selling price minus the buy price minus the buy commission minus the sale commission. Fill out securely sign print or email your qualified dividends tax worksheetpdffillercom 2015-2020 form instantly with SignNow.

2015 qualified dividends and capital gain tax worksheet

Capital Gain Tax Worksheet - 2015 Form 1040Line 44 ... 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. 38 Qualified Dividends And Capital Gain Tax Worksheet ... Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax amount. 1 don t churn your portfolio you want to pay the long term capital gains rate and pay that as infrequently as possible. Do the job from any device and share docs by email or fax. Carryover Worksheet - Fill Out and Sign Printable PDF ... 2019 Capital Loss Carryover Worksheet. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. ... qualified dividends and capital gain tax worksheet 2020. capital loss carryover worksheet 2019 to 2020. ... Get more for Capital Loss Carryover Worksheet To. Form g 7 2015; Abl 500 ftp ...

2015 qualified dividends and capital gain tax worksheet. Dividends Gain Qualified And Form Capital Tax Worksheet ... Similarly, for the 2020 tax year, the capital gains rate, is the same as 2018 but the brackets changed slightly due to inflation As of the date of publication, if your marginal income tax rate is 25 percent or less, qualified dividends are non-taxable They are generally lower than short-term capital gains tax rates The following information is ... Qualified Dividends and Capital Gain Tax - TaxAct Qualified Dividends and Capital Gain Tax With the passing of the American Taxpayer Relief Act of 2012, certain taxpayers may now see a higher capital gains tax rate than they have in recent years. The new tax rates continue to include the 0% and the 15% rates; however, will also now include a 20% rate. Qualified Dividend And Capital Gains Worksheet 2020 and ... Amazing Qualified Dividend And Capital Gain Tax Worksheet ... best theblacknessproject.org. Page 1 federal worksheets john brown 554-78-4556 2020 12821 0209pm qualified dividends and capital gain tax worksheet form 1040 1040-sr or 1040-nr line 16 1. The 500 of qualified dividends shown in box 1b of Form 1099-DIV are all qualified dividends because you held the stock for 61 days of the 121-day ... 35+ Ideas For Qualified Capital Gains Worksheet 2015 30 Qualified Dividends And Capital Gain Tax Worksheet Calculator Worksheet Resource Plans. Dean Lance And Wanda 2015 Acc 321 Tax Accounting I Msu Studocu. Form 1040 Schedule J Income Averaging Form For Farmers And Fishermen 2015 Free Download.

united states - How to handle capital gains on a Virginia ... I reported capital gains (reported to me on a 1099-DIV) on my 2015 Form 1040A "U.S. Individual Income Tax Return" (line 10.) Using the "Qualified Dividends and Capital Gain Tax Worksheet" on p. 38 of the 2015 1040A instructions, these capital gains were taxed federally at a 15% rate, which is lower than my income tax rate for wages. FREE 2015 Printable Tax Forms | Income Tax Pro Qualified Dividends and Capital Gain Tax Worksheet Simplified Method Worksheet Social Security Benefits Worksheet Standard Deduction Worksheet for Dependents Student Loan Interest Deduction Worksheet. All of the 2015 federal income tax forms listed above are in the PDF file format. The IRS expects your 2015 income tax forms to be printed on ... 2014 Qualified Dividends and Capital Gain Tax Worksheet ... 2014 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line ... " " " " ; 9 p m o B B 9 ! ! Sep 2, 2016 — Qualified Dividends and Capital Gain Tax Worksheet. No. Schedule D (Form 1040) 2015. (. ) Schedule D (Form 1040) 2015.56 pages

How to Figure the Qualified Dividends on a Tax Return ... Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax... Qualified Dividends And Capital Gain Worksheet Qualified Dividends And Capital Gain Tax Worksheet. 2015 2022 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller. 2011 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller. Review Alexander Smith S Information And The W2 Chegg Com. 2015_TaxReturn_GregAbbott.pdf 2015 estimated tax payments and amount applied from 2014 return ... Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions.14 pages capital_gain_tax_worksheet_1040i - 2015 Form 1040Line 44 ... 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43.

Get the free qualified dividends and capital gain tax ... 2015 Form 1040 Line 44 Qualified Dividends and Capital Gain Tax Worksheet Line 44 Keep for Your Records Before you begin: 1. 2. 3. 4. 5. 6. 7.

Schedule D Tax Worksheet 2015 - worksheet Before completing this worksheet complete form 1040 through line 43. 2015 tax computation worksheet. Tax computation worksheet form 1040 instructions html. This form may be easier to complete if you round off cents to whole dollars. Otherwise complete the qualified dividends and capital gain tax worksheet in the instructions for forms 1040 and ...

38 capital gain worksheet 2015 - Worksheet Resource Qualified Dividends and Capital Gain Tax Worksheet 2015-2022 Form. Use the qualified dividends and capital gain tax worksheet 2020 2015 template to simplify high-volume document management. Checked the box on line 13 of Form 1040. Enter the amount from Form 1040, line 43.

PDF and Losses Capital Gains - IRS tax forms Exclusion of Gain on Qualified Small Business (QSB) Stock, later. If there is an amount in box 2d, in-clude that amount on line 4 of the 28% Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D. If you received capital gain distribu-tions as a nominee (that is, they were paid to you but actually belong to some-

42 qualified dividends and capital gain tax worksheet ... Qualified Dividends and Capital Gain Tax Worksheet for Forms 1040 and 1040-SR, line 12a (or in the instructions for Form 1040-NR, line 42). This worksheet derives only the self-employed income by analyzing Schedule C, F, K-1 (E), and 2106. 6%) were subject to the maximum long-term capital gains and qualified dividends rate (20%).

2015 Instructions for Schedule D - Capital Gains and Losses To report a gain or loss from a partnership, S corporation, estate or trust, To report capital gain distributions not reported directly on Form 1040, line 13 (or effectively connected capital gain distributions not reported directly on Form 1040NR, line 14), and To report a capital loss carryover from 2014 to 2015. Additional information.

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

Qualified Dividends and Capital Gains Worksheet - ACC330 ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

PDF 2015 Form 6251 - IRS tax forms Enter the amount from line 7 of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44, or the amount from line 19 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the

2015 tax return - eFile.com 13 Capital gain or (loss). ... Form 1040 (2015) BARACK H. & MICHELLE L. OBAMA ... Complete the Qualified Dividends and Capital Gain Tax Worksheet in the ...45 pages

Free Microsoft Excel-based 1040 form available ... Line 44 - Qualified Dividends and Capital Gain Tax Worksheet; Line 52 - Child Tax Credit Worksheet; Lines 64a and 64b - Earned Income Credit (EIC) Six additional worksheets round out the tool: W-2 input forms that support up to 4 employers for each spouse; 1099-R Retirement input forms for up to 4 payers for each spouse; SSA-1099 input ...

How to Dismantle an Ugly IRS Worksheet | Tax Foundation How to Dismantle an Ugly IRS Worksheet. February 27, 2015. Alan Cole. Alan Cole. In filing my own taxes, the most difficult part to calculate has always been the Qualified Dividends and Capital Gain Tax worksheet. I often have to do it several times in order to make sure I did not mess it up. And I work for Tax Foundation!

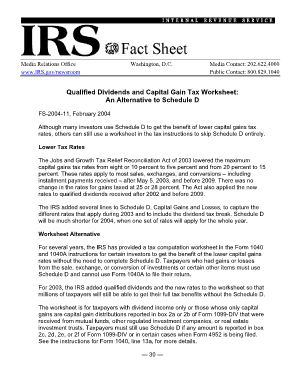

PDF Qualified Dividends and Capital Gain Tax Worksheet: An ... rates to qualified dividends received after 2002 and before 2009. The IRS added several lines to Schedule D, Capital Gains and Losses, to capture the different rates that apply during 2003 and to include the dividend tax break. Schedule D will be much shorter for 2004, when one set of rates will apply for the whole year. Worksheet Alternative ...

2015 Form 1099-DIV instructions - Vanguard You also must complete the Qualified Dividends and Capital Gain Tax Worksheet included in the Form 1040 or 1040A instructions to determine your taxes due on ...6 pages

Carryover Worksheet - Fill Out and Sign Printable PDF ... 2019 Capital Loss Carryover Worksheet. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. ... qualified dividends and capital gain tax worksheet 2020. capital loss carryover worksheet 2019 to 2020. ... Get more for Capital Loss Carryover Worksheet To. Form g 7 2015; Abl 500 ftp ...

38 Qualified Dividends And Capital Gain Tax Worksheet ... Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax amount. 1 don t churn your portfolio you want to pay the long term capital gains rate and pay that as infrequently as possible. Do the job from any device and share docs by email or fax.

Capital Gain Tax Worksheet - 2015 Form 1040Line 44 ... 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43.

![Solved] Lisa Kohl (age 44) is a single taxpayer and she lives ...](https://s3.amazonaws.com/si.experts.images/questions/2021/07/61028bc85ff2c_1627556806698.jpg)

0 Response to "40 2015 qualified dividends and capital gain tax worksheet"

Post a Comment