40 cancellation of debt worksheet

So, if you got a form 1099 indicating your debt was canceled and it wasn't a bankruptcy discharge that canceled it, get out the worksheet and see if you were insolvent when the debt was canceled. If you were insolvent by the IRS reckoning, check the box on Form 982 and submit it with your return. More on debt forgiveness cancelled debts, cancellation of debt, in addition to any gain or loss from the sale. Cancelled debt is intended as gift. Amount cancelled is not income.* * Gift tax may apply. Form 1099-C, Cancellation of Debt If a lender cancels or forgives a debt of $600 or more, it must provide the borrower with Form 1099-C, showing

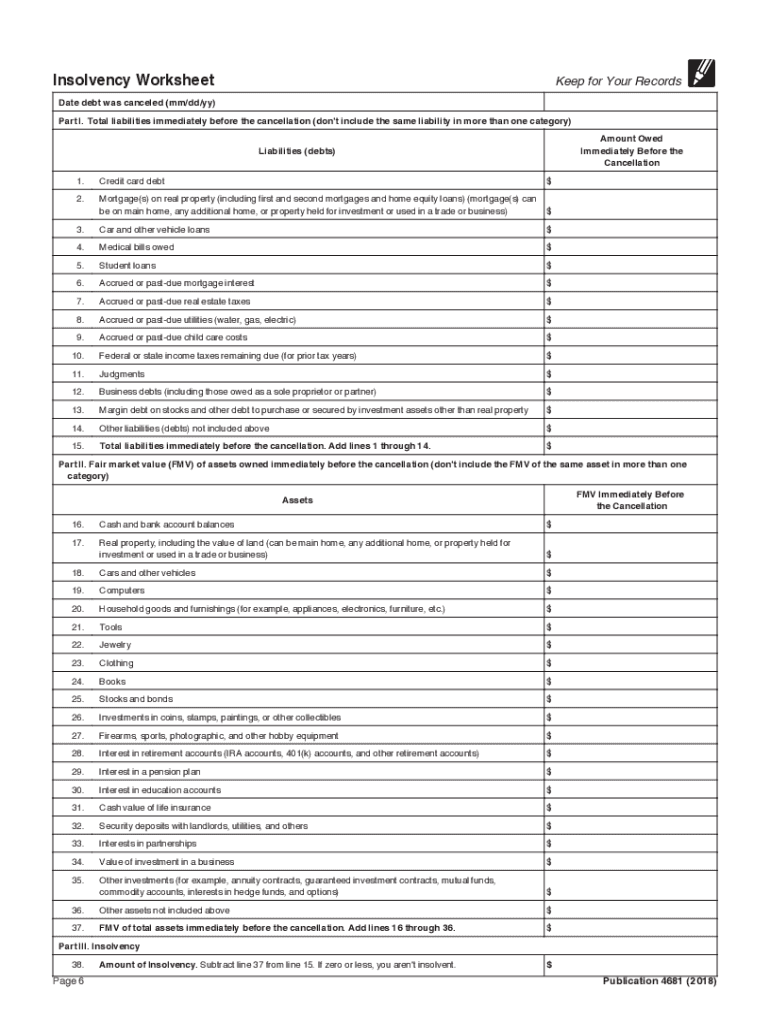

Second, the debt that was canceled may be excludable from taxable income to the extent that you are considered "insolvent" immediately prior to the cancellation of the debt. The Internal Revenue Service has provided an Insolvency Worksheet to assist taxpayers in determining whether they are considered insolvent.

Cancellation of debt worksheet

The Attorney General's Office has the legal authority to accept and attempt to resolve disputes concerning issues that arise from mobile/manufactured tenancy where an individual owns the home and rents a lot for the home in a mobile/manufactured home park. If this applies to you contact the Manufactured Housing Dispute Resolution Program at (866) WAG-MHLTA (1-866 … debt to be included on the Schedule C on the Cancellation of Debt Worksheet (Figure 1 8). The net income amount is reported as other income on Schedule C, Page 1, line 6 (Figures 19 and 20). Data-Entry Examples for Cancellation of Debt, Abandoned, Foreclosed, or Repossessed Property: UltraTax/1040 TL 25614 If you borrow money and are legally obligated to repay a fixed or determinable amount at a future date, you have a debt. You may be personally liable for a debt or may own a property that's subject to a debt.

Cancellation of debt worksheet. Cancellation of Debt - Insolvency It includes a worksheet for a taxpayer to determine if he or she is insolvent and it explains the tax implications of cancelled debt. HIGHLIGHTS: Tax treatment of cancelled debt. Form 1099-C, Cancellation of Debt. Taxpayer insolvency and insolvency worksheet. Reduction of tax attributes due to discharge of debt. 07.01.2022 · Determine how much your stash of Southwest Rapid Rewards points is worth and decide which flights are high-value redemptions. Type in CAN to highlight the line labeled Canceled Debt. Click OK to open the Canceled Debt Worksheet. Scroll down to the Business, Farm, and Rental Debt Smart Worksheet below line 30. Double-click one of the following options to link the 1099-C to that activity: Schedule C, Business Schedule E, Rental Schedule F, Farm Form 4835, Farm Rental Nonbusiness credit card debt cancellation. ... Greg uses the Insolvency Worksheet to determine that his total liabilities immediately before the cancellation were $15,000 and the FMV of his total assets immediately before the cancellation was $7,000. This means that immediately before the cancellation, Greg was insolvent to the extent of $8,000 ...

Squawkfox Debt Reduction Spreadsheet . The author of the spreadsheet and the Squawkfox blog, Kerry Taylor, paid off $17,000 in student loans over six months using this downloadable Debt Reduction Spreadsheet.. Start by entering your creditors, current balance, interest rates, and monthly payments to see your current total debt, average interest rate, and average monthly interest paid. You were insolvent to the extent that your liabilities exceeded the fair market value (FMV) of your assets immediately before the discharge. For details and a worksheet to help calculate insolvency, see Pub. 4681. ... You were released from your obligation to pay your credit card debt in the ... Welcome, click here to get started. (Be sure to print and/or save document when completed before closing.) Serving the Asheville area since 1989 For over 30 years, our knowledgeable tax professionals have provided clients with premium service for a reasonable preparation fee! May 1, 2020 - If you receive a Form 1099-C, Cancellation of Debt, you will need to determine whether you will be taxed on the amount of your debt that was canceled or forgiven. IRS Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments has an insolvency worksheet you can use to determine ...

You can only exclude cancellation of debt income to the extent that you are considered insolvent. By applying this method you will not be taxed on the cancelled debt. Please fill out the Insolvency Worksheet provided below. Insolvency Worksheet Bankruptcy If your debt was cancelled in conjunction with Title 11 bankruptcy proceeding Chapter 7 or ... April 24, 2016 - Claiming insolvency If you fill out the insolvency worksheet with the amounts of your pre-cancellation debts and the value of your assets, you arrive at a positive number on the last line, you're considered insolvent for IRS purposes. In order to exclude the canceled debt from your taxable ... 19.04.2021 · Tax on Gifts in India: Gifts up to Rs 50,000 per annum are exempt from tax in India and gifts from relatives like parents, spouse and siblings are also exempt from tax. Cancellation of Debt - Qualified Real Property Business Debt Worksheet This tax worksheet determines if a taxpayer is qualified to exclude income from the discharge of qualified real property business debt and to calculate the amount of excludable income. For further assistance:

The practical guides and resources in this section will help you deal with your legal problem or represent yourself in a court or tribunal. You will find step-by-step guides for going to court, as well as sample forms and answers to your frequently asked questions.

In the worksheet, you will list all your assets and liabilities. Be careful to only list assets you acquired before the day of debt cancellation. For the values of assets and liabilities, you must use the values they had on the debt cancellation day.

This message is from Nina Olson, the National Taxpayer Advocate and your voice at the IRS. It is one of a series of videos with consumer tax tips about impor...

Freedom Debt Relief negotiates with creditors to settle your debts for less than you owe. Its debt settlement program is costly and results are not guaranteed.

December 7, 2020 - Problem Description How do I complete the Canceled Debt Worksheet? Form 1099 C Solution Description CANCELLATION OF DEBT WORKSHEET PURPOSE This worksheet is used to compute: Gross income Exclusions from gross income Gain or Loss Resulting from: foreclosure repossession abandonment short sale loan...

Insolvency Worksheet - Publication 4681--Canceled Debts, Foreclosures, Repossessions, and Abandonments - Page 6 ... Insolvency Worksheet - Publication 4681--Canceled Debts, Foreclosures, Repossessions, and Abandonments - HTML

If you received a Form 1099-A, the first thing you must do is determine whether there has actually been a cancellation of debt. The lender should have sent you a Form 1099-C Cancellation of Debt if any debt was canceled. If you have not received a Form 1099-C, you may want to contact your lender to determine if any debt has been canceled.

Method 1: Have the cancellation of debt flow to the 1040, Line 21 as Other Income. Method 2: Fill out the Deferral of Income Recognition From Discharge of Indebtedness. Method 3: Have the cancellation of debt show as a Gain. Method 1: To have the amounts from the IRS 1099-C flow to the 1040 line 21 as other income -

Debt consolidation advisors and companies typically evaluate your high-interest debt and financial resources and develop a plan to cut the high interest rates and get you a lower monthly payment. In short, what they do is take charge of you...

Cancellation of Debt ... Worksheet by: William Roos, EA, roos@bigsky.net Revised 11-27-12 NOTE: Do not use a spouse’s separately owned assets in computing the taxpayer’s insolvency. If any assets or liabilities are separately owned, use a separate worksheet for each spouse.

cancellation of nonbusiness indebtedness or cancellation of debt (the amount in Form 1099 -C is less than $600 provided in other Visuals: Form 1040 Form 1099 -MISC, boxes 3 Form 1099 -C Pub 4012 , Income tab: •Nonbusiness Credit Card Debt Cancellation •Insolvency Determination Worksheet

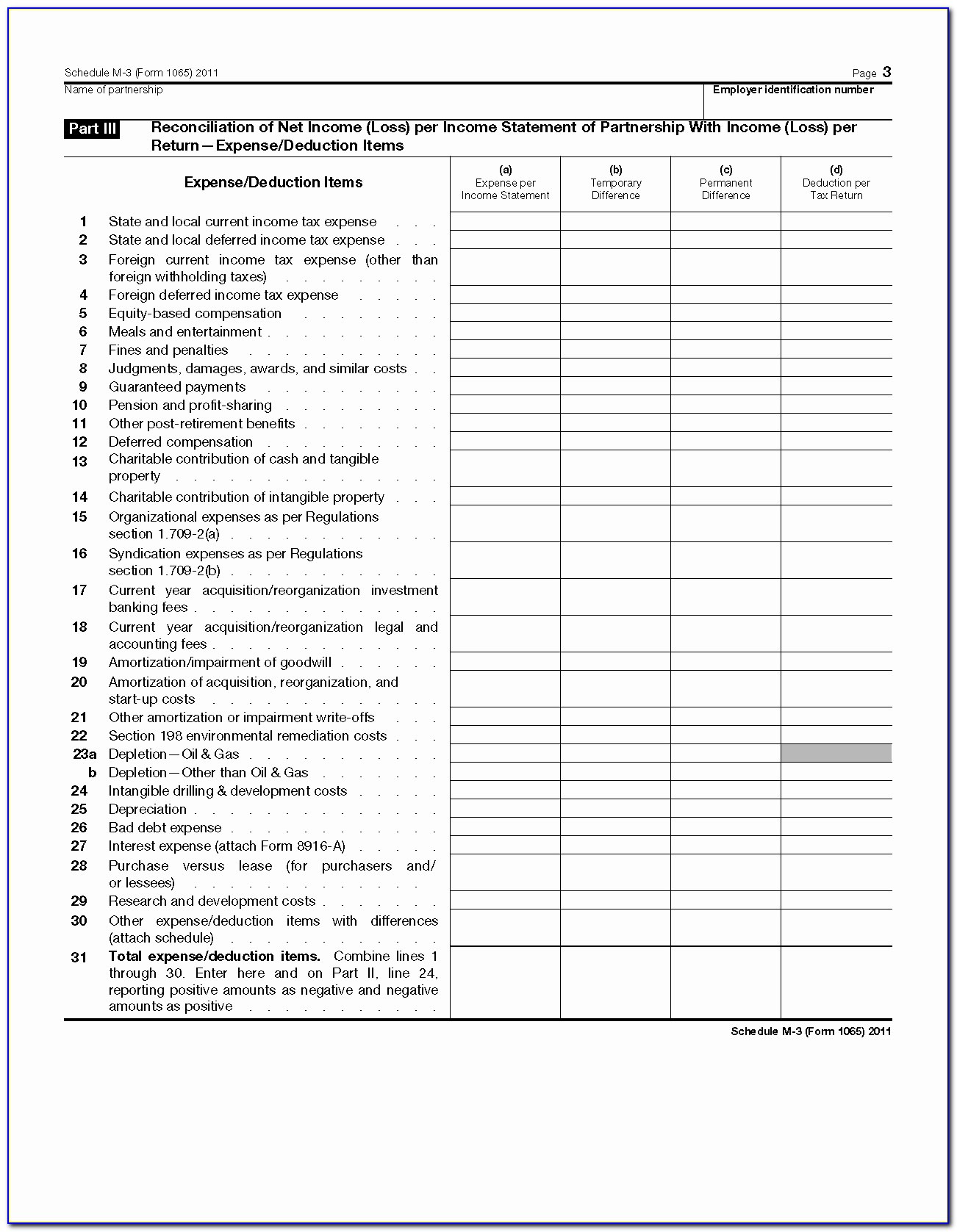

Line 11E - Cancellation of Debt - The amount in Box 11, Code E represents the taxpayer's portion of partnership debt that was cancelled. Generally, this cancellation of debt amount is included in the taxpayer's gross income and this amount will automatically be carried to Form 1040, Schedule 1, Line 21.

You are deemed to be insolvent if your total liabilities (debts) are greater than your total assets. Completing the insolvency worksheet at the bottom of this document will help you determine if you were insolvent at the time your debt was discharged. For example, if your total liabilities ...

Cancellation of Debt Insolvency Worksheet. This tax worksheet calculates a taxpayer’s insolvency for purposes of excluding cancellation of debt income under IRC Sec. 108. A debt includes any indebtedness whether a taxpayer is personally liable or liable only to the extent of the property securing the debt. Cancellation of all or part of a debt that is secured by property may occur because of a foreclosure, a repossession, a voluntary return of the property to the lender, abandonment of the ...

You do not include canceled debt in your income to the extent you are insolvent immediately before the cancellation. Insolvent immediately before the cancellation means: your liabilities exceed the FMV of your assets the day before the cancellation. IMPORTANT ADVICE: Keeping your Records for this worksheet could prove to be important. Print out ...

The IRS provides an insolvency worksheet for borrowers who recently received debt cancellation. To complete the worksheet, you'll need to list all of your debts (credit cards, auto loans, personal ...

On line 2, include the smaller of the amount of the debt canceled or the amount by which you were insolvent immediately before the cancellation. You can use the Insolvency Worksheet to help calculate the extent that you were insolvent immediately before the cancellation.

UltraTax CS produces a Cancellation of Debt Worksheet to show how the net amount of canceled debt included in income was calculated. The worksheet also reports the exception or exclusion to the canceled debt to be excluded from income. Canceled debt income is reported on the form or schedule selected in the Form/Schedule field in Screen 1099C.

The amount of debt on my personal loan that was discharged is 16161.52. I wanted to fill out an insolvency worksheet to include on form 982. Accountant's Assistant: Is there anything else the Accountant should be aware of? I don't have much in my personal checking account and I have over $7000 worth of credit card debt.

celed, you may be able to exclude the canceled debt from income if the cancellation occurred in a title 11 bankruptcy case or you were insolvent immediately before the cancellation. You should read Bankruptcy or Insolvency under Exclusions in chapter 1 to see if you can ex-clude the canceled debt from income under one of those provisions.

The answer is yes, based on the IRS worksheet and your numbers. Life insurance would fall under the category of 'Other liabilities' on the worksheet. See IRS Publication 4681 for more information about insolvency. This is a worksheet that is prepared to determine if you can qualify for eliminating taxable income form a cancelled debt (Form 1099-C).

Nonbusiness credit card debt cancellation. If you had a nonbusiness credit card debt can-celed, you may be able to exclude the canceled debt from income if the cancellation occurred in a title 11 bankruptcy case or you were insolvent immediately before the cancellation. You should read Bankruptcy or Insolvency under

Fill Insolvency Worksheet Excel, Edit online. ... Get the free insolvency worksheet excel form. Get Form ... Fill insolvency canceled debts: Try Risk Free.

Cancelled debt is intended as gift.Amount cancelled is not income.* * Gift tax may apply. Form 1099-C, Cancellation of Debt If a lender cancels or forgives a debt of $600 or more, it must provide the borrower with Form 1099-C, showing the amount of cancelled debt to be reported as income. Generally, you must include all cancelled amounts,

Always review this section before starting your shift! + Volunteer Alerts + TaxSlayer Pro Blog [check here when having software issues] + Meet Your Trainers! + Changes for 2020...

5/26/2016 4 Foreclosure Worksheet #1 Figuring Cancellation of Debt Income The amount on line 3 will generally equal the amount shown in box 2 of Form 1099‐C.

A taxpayer is insolvent when his or her total liabilities exceed his or her total assets. The forgiven debt may be excluded as income under the "insolvency" exclusion. Normally, a taxpayer is not required to include forgiven debts in income to the extent that the taxpayer is insolvent.

Determine if any of the debt canceled on your principal residence is required to be included as income on your federal tax return. An official website of the United States Government ITA Home This interview will help you determine if any of...

Cancellation of Debt (COD) 1-21 Cancellation of Debt - Nonbusiness Credit Card Debt Cancellation Generally, if a taxpayer receives Form 1099-C for canceled credit card debt and was solvent immediately before the debt was canceled, all the canceled debt will be included on Form 1040, line 21, Other Income.

This is the next installment of the Mini Financial Binder.We are kicking off this year with a series of free printables to help you take control of your budget. Included is the Daily Spending Log, Expense Tracker, Debt Payoff Tracker (this one), Monthly Bill Worksheet and as a bonus, you can get the Monthly Goals and Yearly Goals Trackers!. 📎 Why You'll Love This Tracker

In general, if you're liable for tax because a debt was canceled, forgiven, or discharged, you'll receive an Form 1099-C, Cancellation of Debt, from the lender or the person who forgave the debt. You may receive an IRS Form 1099-C while the creditor is still trying to collect the debt. If so, the creditor may not have canceled it.

Total Amount of Cancelled debt shown on all 1099-C and other documents $. Debts: Credit Cards_________________. Student loans____________________.

Sample response to a letter of demand This is an example of a response to a letter of demand. It is important to write your response using your own details and based on your own circumstances.

Click here to review Michelle's Form 1099-C.. Click here to review the Insolvency Determination Worksheet for Michelle's assets and liabilities.. Click here to view Publication 4731, the Screening Sheet for Nonbusiness Credit Card Debt Cancellation..

Form 1099-C (Cancellation of Debt), fill out accordingly Form 982, you will need to indicate the reason for the discharge within Part 1 General information and you will need to include an amount within Part II Reduction of Tax Attributes (accordingly to the reason) Canceled Debt Worksheet (fill out the Part accordingly to your reason or exclusion)

1. Consumer Credit Card Debt Cancellation of non-business credit card debt may be non-taxable if at the time of the cancellation the taxpayer was insolvent or had filed bankruptcy. The screening sheet for cancellation of credit card debt is found of page D-58 of Publication 4012. To determine insolvency, use the worksheet on page D-59 of

Debt can sneak up on you and, before you know it, you’re overextended with medical bills, student loans and credit card balances. You might consider debt consolidation, but this is an important decision. Maybe you need help with debt collec...

Appendix E: Debt Suspension Agreement and Debt Cancellation Contract Forms and Disclosure Worksheet. This worksheet shows the required content of the disclosures that must be included in each DSA or DCC contract according to 12 CFR 37.6(a). This regulation applies to national banks only.

If you borrow money and are legally obligated to repay a fixed or determinable amount at a future date, you have a debt. You may be personally liable for a debt or may own a property that's subject to a debt.

debt to be included on the Schedule C on the Cancellation of Debt Worksheet (Figure 1 8). The net income amount is reported as other income on Schedule C, Page 1, line 6 (Figures 19 and 20). Data-Entry Examples for Cancellation of Debt, Abandoned, Foreclosed, or Repossessed Property: UltraTax/1040 TL 25614

0 Response to "40 cancellation of debt worksheet"

Post a Comment