39 understanding a credit card statement worksheet answers

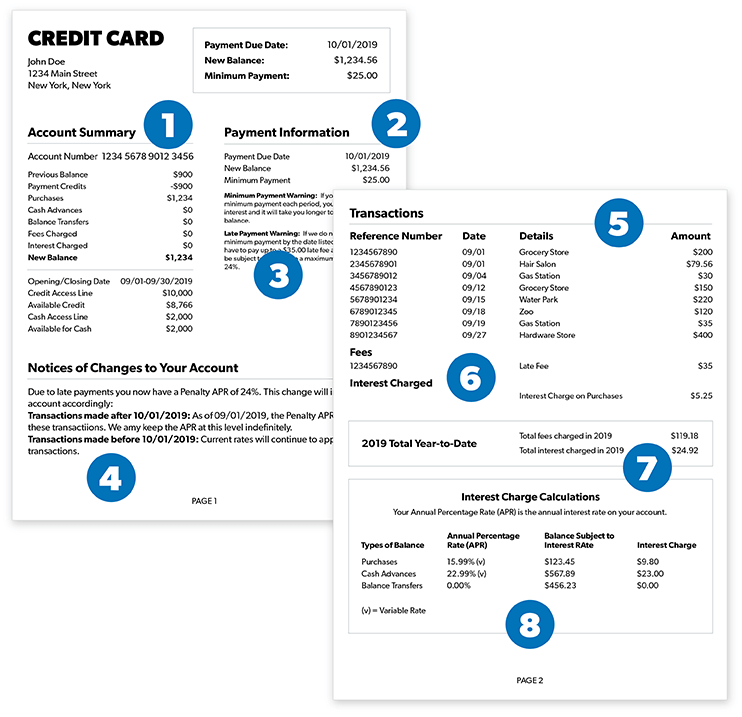

Understanding a Credit Card Statement Total Points Earned Name Total Points Possible Date Percentage Class Directions: Refer to the credit card statement to answer the following questions. Section What type of information is in this section? Why is this section important to review/understand? A good credit history makes borrowing easier. Lois bought clothing at a store. She did not have enough in her bank account to pay for the purchase. After receiving the bill and paying off the balance, she realized that she paid $9.69 in interest. Which statement is true about her method of payment.

Understanding Credit Cards: How To Read a Credit Card Statement. by Amy Lillard. Credit and credit cards are an integral part of our economic system today. But there is a lot of misinformation and misunderstandings about credit.

Understanding a credit card statement worksheet answers

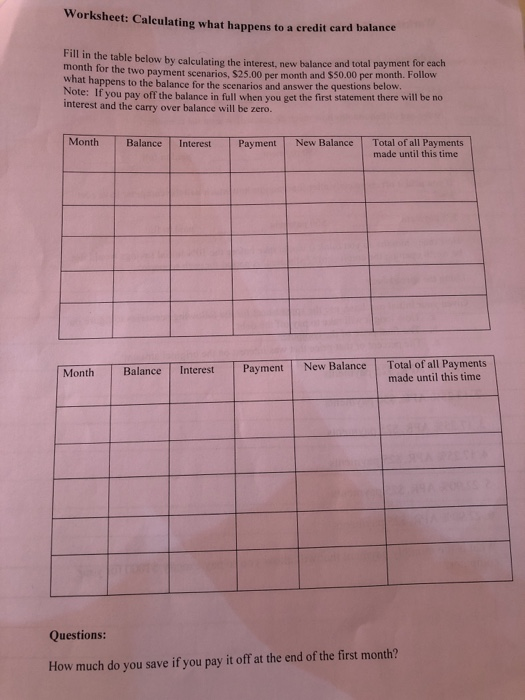

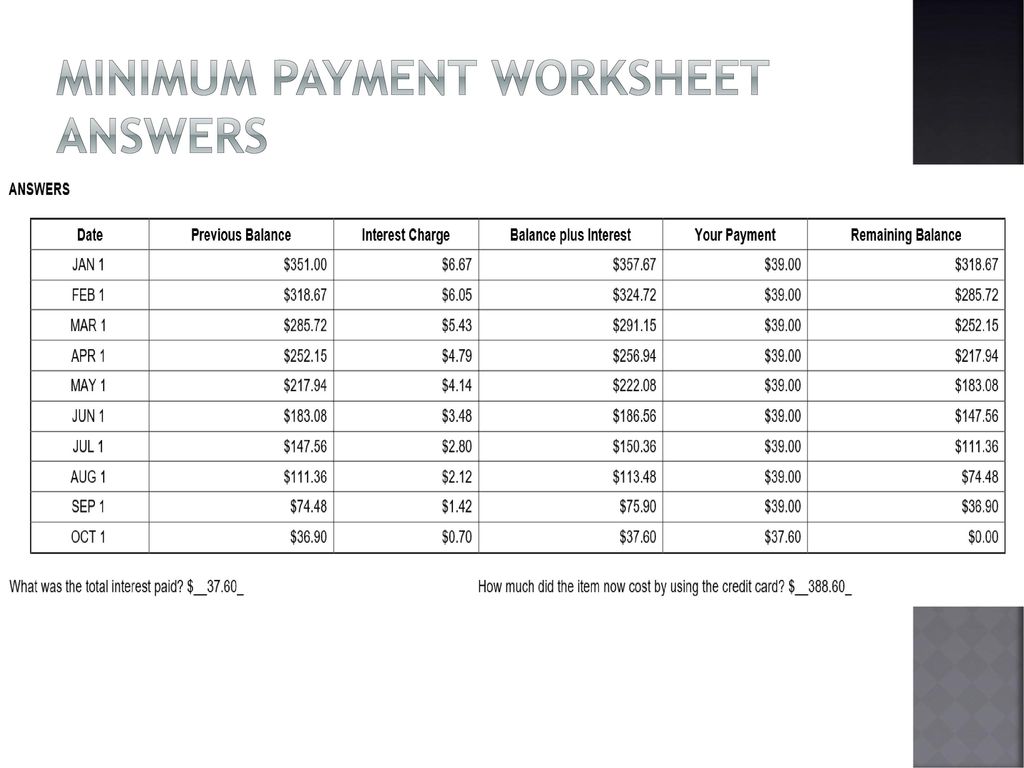

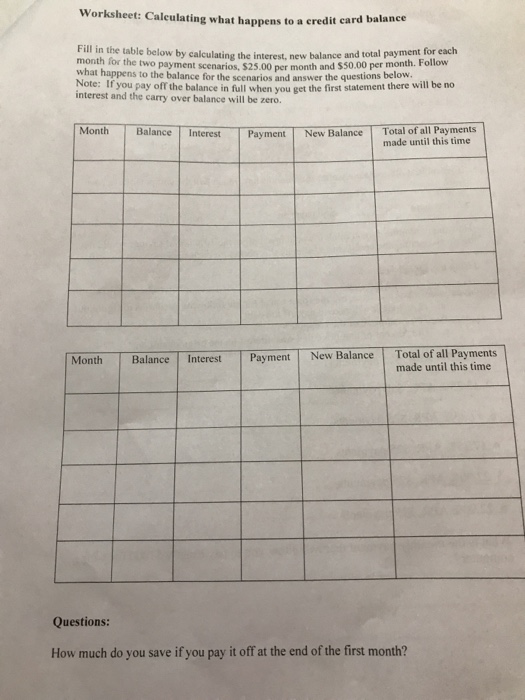

Credit card issuers have a legal requirement to send your monthly credit card statement at least 21 days before your minimum payment due date. 1 Billing statements usually consist of one or two pages containing a good deal of information about what you've charged, how much you paid last month, what payment you need to make, and the date by ... View reading_a_credit_card_statement_wkst (1).pdf from ECONOMICS 101 at Winter Springs High School. 7.4.2.A2 Worksheet Understanding a Credit Card Statement 15 Total Points Earned Total Points Suggested Age: 6-8 grades. Use this TD lesson plan and worksheet to teach students how to balance a checkbook. They'll then be given a case study of someone's spending, and need to balance that person's checkbook with the provided worksheet. 3. Introduction to Earning Interest.

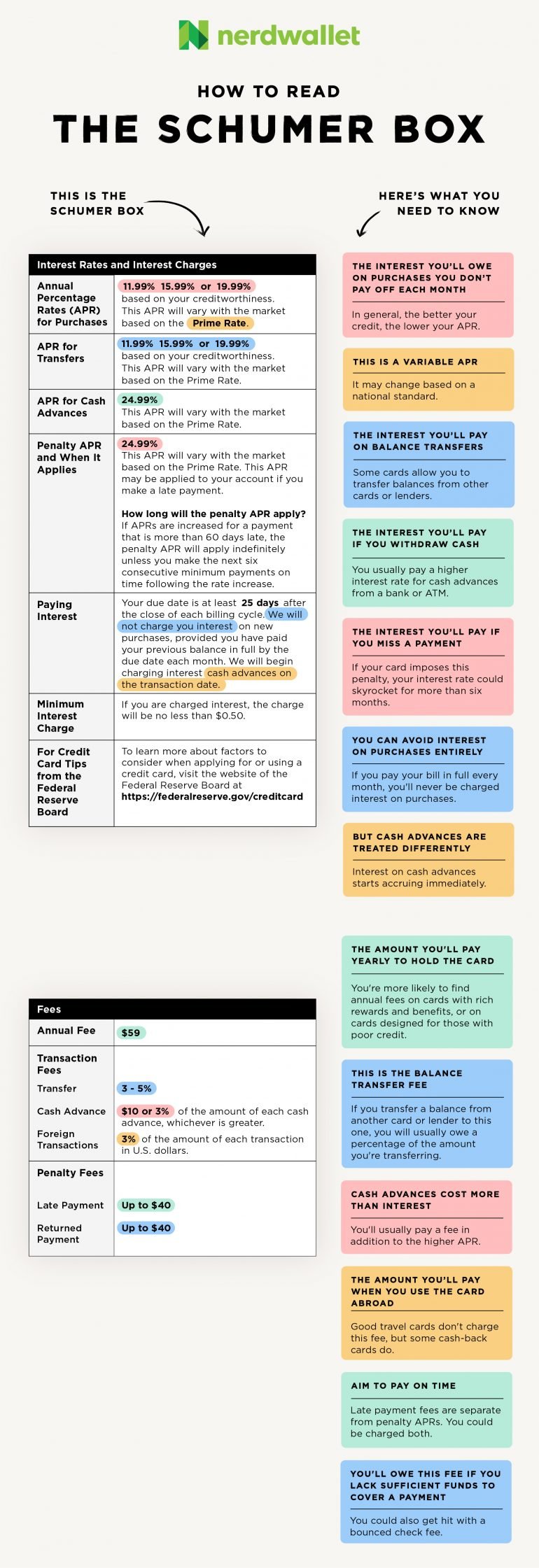

Understanding a credit card statement worksheet answers. Understanding a credit card for personal finance: key terms. Terms in this set (17) Annual Fee. A yearly fee that may be charged for having a credit card. Annual Percentage Rate (APR) The cost of credit expressed as a yearly interest rate. Balance Transfers. Dec 09, 2021 · Understanding A Credit Card Statement Worksheet 2.6 3 A2 Answers. To help the youngster command words that concepts may well not enable him, these worksheets utilize action verbs. An individual’s actions have a straight effect as well as share immediate information. They assist the trainee in comprehending the topic in a fair and also distinct way. Explain the credit card application and approval process. Analyze a credit card statement. Understand the protections and rights available to credit card holders. Review safety tips when using credit cards. Introduction Twenty-one year old Jenny felt rich when she received her first credit card during her junior year of college. She charged Credit Cards: Quiz & Worksheet for Kids. Quiz. Course. Try it risk-free for 30 days. Instructions: Choose an answer and hit 'next'. You will receive your score and answers at the end. question 1 of 3.

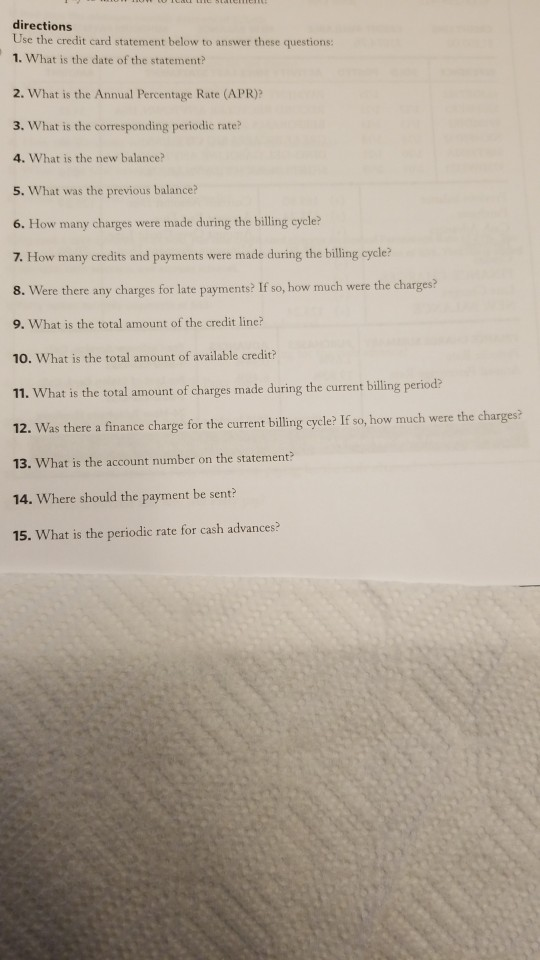

Write the following question on the whiteboard: what is a credit card statement? 2. Read the question aloud and allow students to share their responses. Write the correct responses on the whiteboard 3. Explain to students a credit card statement is a summary of how the cardholder has used their credit card for a certain period of time (billing period) Understanding a Credit Card Statement Total Points Earned Name 15 Total Points Possible Date Percentage Class Directions: Refer to the provided credit card statement to answer the following questions. 1. What is the current APR for purchases, balance transfers, and cash advances? 3.2 Intro to Credit Cards - Sample Completed Student Activity Packet 9 CALCULATE: Shopping with Interest 13 RESEARCH: Credit Card Laws WebQuest Do More PROJECT: Budgeting for Your Credit Card Payments CQs Intro to Credit Cards Comprehension Questions *No Answer Key available - assignment is open-ended. B ack to Top www.ngpf.org Last updated: 4 ... Understand how to read a credit card agreement through a step-by-step analysis of the Schumer Box (Note: The Schumer Box summarizes key terms of the agreement) Analyze the different fees associated with credit cards and how they can be avoided

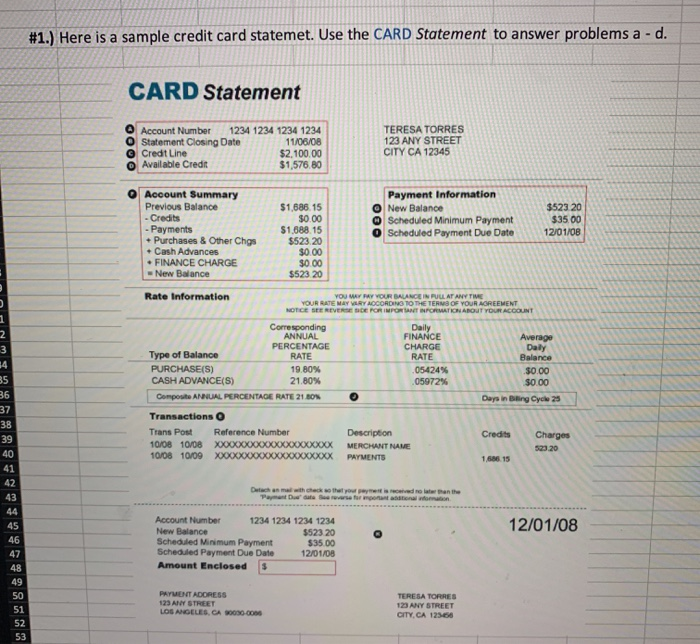

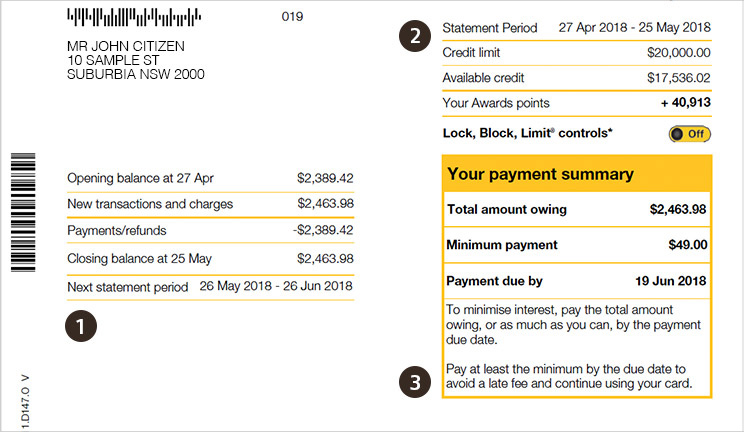

A credit card statement is a summary of how you've used your credit card for a billing period. If you've ever looked at credit card statements, you know how difficult they can be to read. Credit card statements are filled with terms, numbers and percentages that play a role in the calculation of your total credit card balance. for their teenagers' credit cards. Divide students into teams. Guide teams in using the Internet and credit application forms to compare features of two credit cards: a major credit card and a department store credit card. Have students research answers to specific questions and enter the information onto a chart. (activity 7-4a) Analyze a bar graph of the frequency of different types of credit card fees. Compare the growth of different credit card fee types, including late fees, annual fees, and balance transfer fees, between 2015 and 2018. Source: Bureau of Consumer Financial Protection www.practicalmoneyskills.com understanding credit student activity 7-4b cont. the credit card statement name: date: SEND PAYMENT TO Box 1234 Anytown, USA CREDIT CARD STATEMENT ACCOUNT NUMBER NAME STATEMENT DUE PAYMENT DUE DATE 4125-239-412 John Doe 2/13/19 3/09/19

statement. If any students say that they have read a credit card statement, ask them if it was easy or difficult to understand. § Tell students that they’ll learn how to read a credit card statement. § Distribute the “Analyzing credit card statements” worksheet and the “Sample credit card statement” handout to students.

Credit card answers. Whether you're shopping for a new card or managing an existing card, it helps to have the facts. From late fees to lost cards, get answers to your credit card questions.

Applying for only credit cards that are needed Keeping track of all charges by keeping receipts Checking the monthly credit card statement for errors N Making late credit card payments (this may trigger penalty fees, a higher penalty interest rate, and will hurt the credit

Understanding a Credit Card Statement Name_____ Date_____ Class_____ Directions: Refer to the provided credit card statement to answer the following questions. 1. What is the current APR for purchases, balance transfers, and cash advances? (3 points) 2.

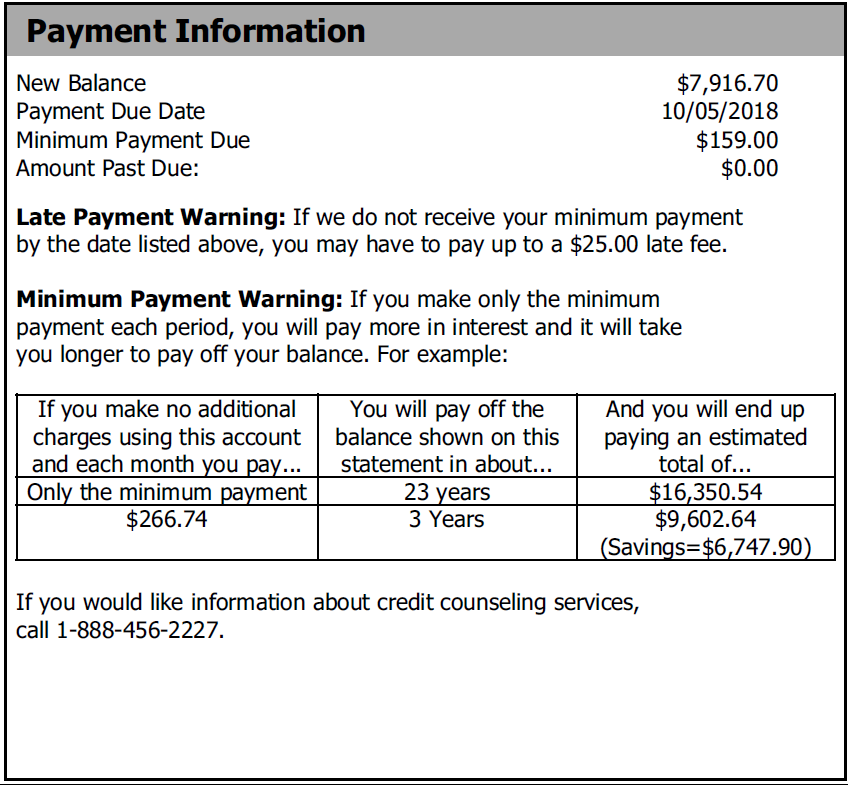

Understanding Credit Card Fees. Interest isn't the only fee you may be charged to use your card. Annual fee: Your card issuer may charge you this fee every year to keep your card active. Annual fees range from as little as $25 to as much as $550 or more. A fee of $95 is common.

This is a random worksheet that includes a person's credit card transactions for the month, and his or her monthly credit card statement. It is the student's task to answer the questions on identifying the parts of the credit card statement. Note: Transactions in this worksheet do not include "payments". ie. A payment is not a transaction.

Sierra Slade Financial Literacy Understanding a Credit Card Statement - 15 points Directions: Refer to the provided credit card statement to answer the following questions.Once you answer the questions submit a screenshot in the submit area. 1. What is the current APR for purchases, balance transfers, and cash advances?

Answers will vary but may include: Whenever a credit card account is closed, the credit card showed be cut into pieces and thrown away. Scenario 7: Ruben found his credit card statement in a stack of papers on his desk.

test your credit knowledge . answer key. In the space provided, write the letter of the type of credit each statement represents. a) Single payment credit b) Installment credit c) Revolving credit . 13. b . 14. a. Monthly telephone bill 15. a. Monthly heating bill 16. c. Using a credit card to buy a new jacket from a department store and then ...

Analyzing credit card statements . Section 2. Reading a credit card statement. Refer to the “Sample credit card statement” handout to answer questions 1–7. 1. What is the balance on the credit card as of 12/30/XX? 2. What is a minimum payment? What is the minimum payment on this credit card statement? 3. What is an annual percentage rate (APR)?

Describe how an individual obtains a credit card. Describe each section of a credit card statement. Credit Card Statement Summary of Account Activity Payment Information Late Payment Warning Minimum Payment Warning Notice of changes to your interest rates Other changes to your account terms

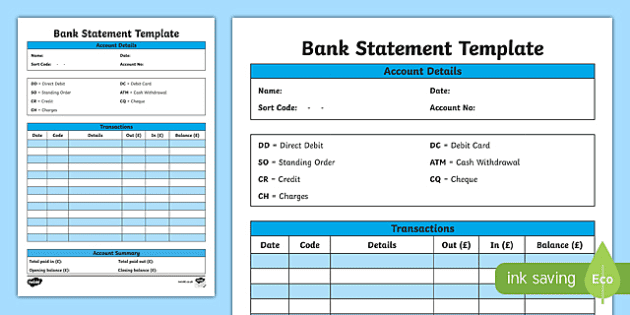

Suggested Age: 6-8 grades. Use this TD lesson plan and worksheet to teach students how to balance a checkbook. They'll then be given a case study of someone's spending, and need to balance that person's checkbook with the provided worksheet. 3. Introduction to Earning Interest.

View reading_a_credit_card_statement_wkst (1).pdf from ECONOMICS 101 at Winter Springs High School. 7.4.2.A2 Worksheet Understanding a Credit Card Statement 15 Total Points Earned Total Points

Credit card issuers have a legal requirement to send your monthly credit card statement at least 21 days before your minimum payment due date. 1 Billing statements usually consist of one or two pages containing a good deal of information about what you've charged, how much you paid last month, what payment you need to make, and the date by ...

0 Response to "39 understanding a credit card statement worksheet answers"

Post a Comment