39 funding 401ks and roth iras worksheet answers

Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET. 2. Funding 401.docx. Lamar University. ECON 3320. ... Funding 401(k)s Funding 401(k)s and Roth IRAs and Roth IRAs Teacher Directions Procedure Hand out Student Activity Sheet. Students will need calculators for this activity. ... Answers Answers AnnuAl sAlAry CompAny mAtCh 401(k) roth IrA ... Read : Funding 401ks And Roth Iras Worksheet Answers Chapter 8. Advantages of printables worksheets for youngsters You can make or acquire them. Suitable for Kindergarten, Kindergarten, as well as Qualities. Your kid's creative thinking can be boosted by them. These worksheets can additionally be used as birthday celebration loot bags.

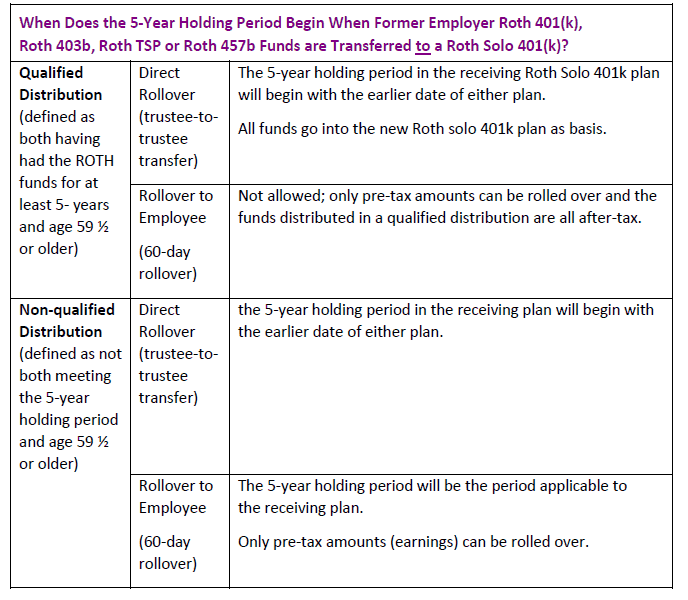

The new Roth 401(k) feature in your plan allows you to invest after-tax dollars (allowing them to grow on a tax- deferred basis) and take qualifying distributions tax-free. The following questions and answers will help you decide if Roth 401(k) contributions are right for you.

Funding 401ks and roth iras worksheet answers

Roth vs. Traditional 401(k) Worksheet ... accounts such as IRAs DETERMINE TRADITIONAL VS. ROTH 401(K) ... p If most of your answers fell under the Roth 401(k) column, you're a good candidate for ... Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Assume each person is following Dave's advice of investing 15% of their annual household income. Remember to follow the sequence of contributions recommended in the chapter. * READ EACH SCENARIO BELOW THE CHART BEFORE ATTEMPTING TO DO THE MATH Joe will take advantage of the ... View Complete Funding 401ks and Roth IRAs Worksheet.jpg from AA 1NAME: DATE: Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Assume

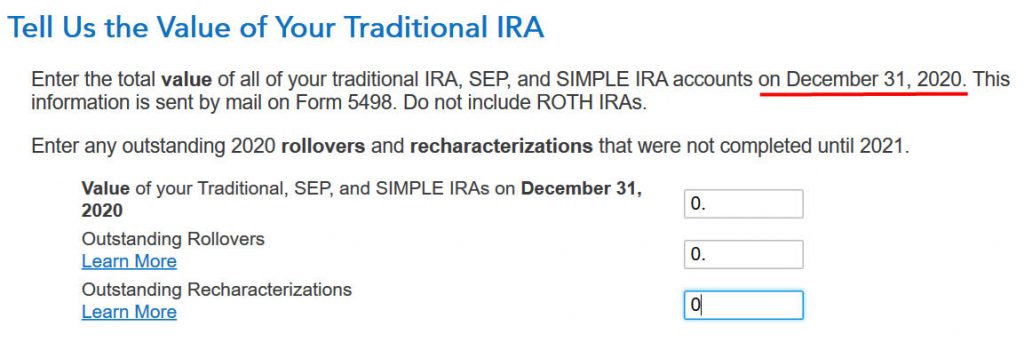

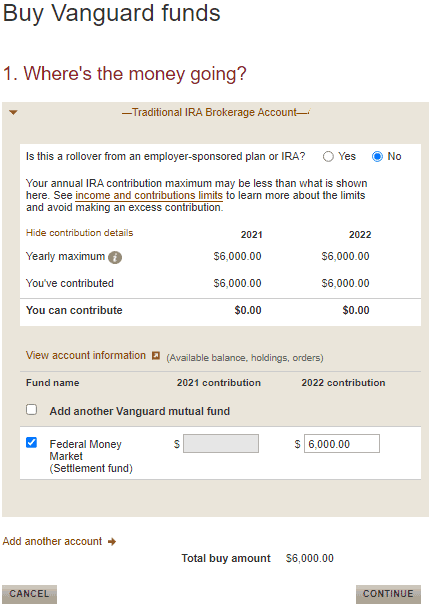

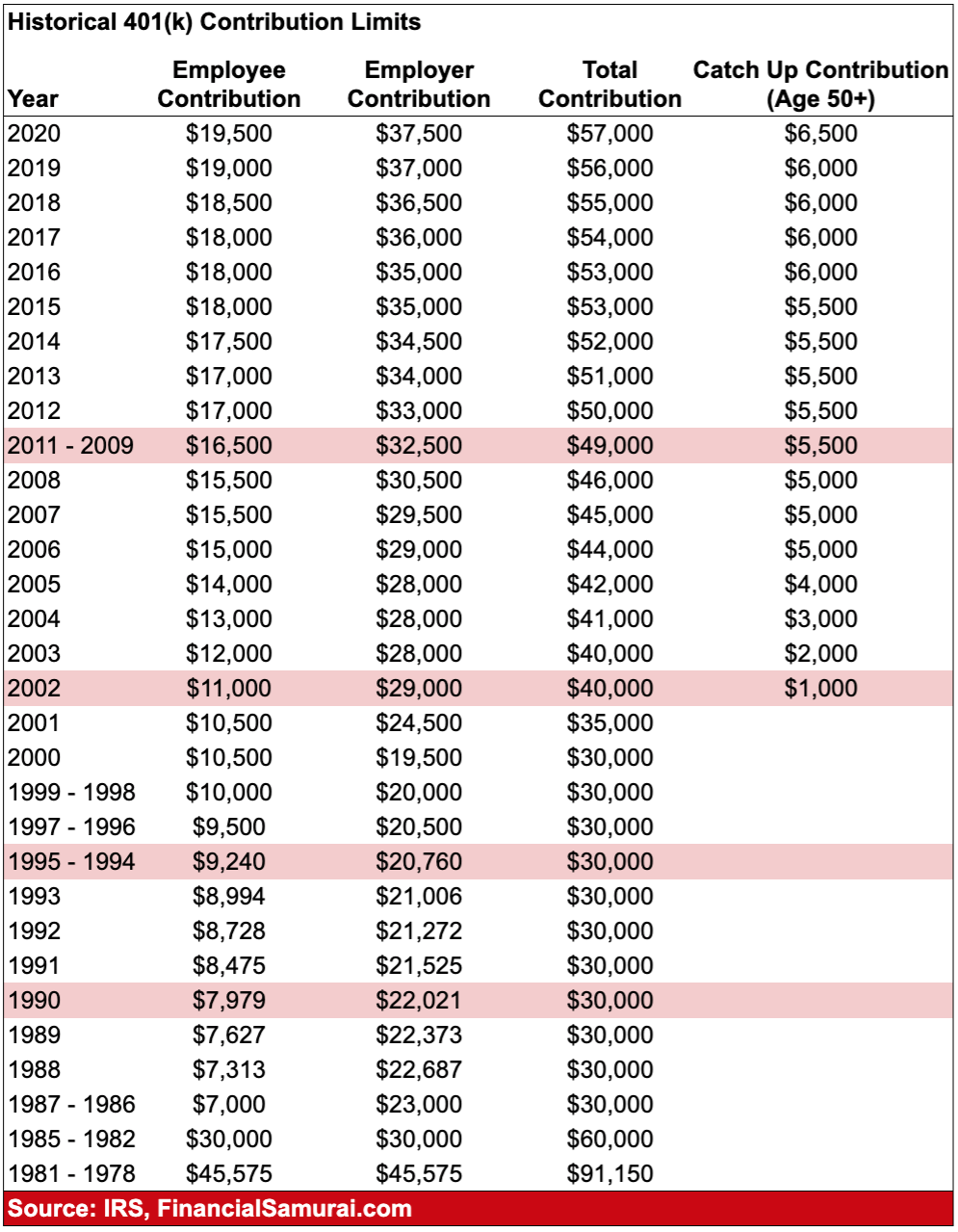

Funding 401ks and roth iras worksheet answers. Funding 401K And Roth Ira Worksheet A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares." Baby Step 4: Invest 15% of household income into Roth IRAs and pre-tax retirement. 1. Fund the 401(k) or other employer plan up to the match (if applicable). 2. Above the match, fund Roth IRAs. If there is no match, start with Roth IRAs. 3. Complete 15% of income by going back to 401(k) or other company plans. Melissa will fund the 401(k) up to the match and put the remainder in her Roth IRA. Tyler and Megan can each fund a Roth IRA then put the remainder in the 401(k). With no match, fund the Roth first (based on 2013 contribution of $5,500 per individual). Adrian is not eligible to open a Roth IRA because he makes too much money. Roth IRAs and 401(k)s: Answers to Readers' Questions ... These accounts include the Roth variety of individual retirement account and also the Roth type of company-sponsored 401(k) savings plan. ...

Roth vs. Traditional 401 (k) Worksheet. Membership Home Portfolio Stocks Bonds Funds ETFs CEFs Markets Tools Real Life Finance Discuss. Articles & Analyst Reports. All Fund Analyst Reports. Target ... FUND YOUR 401 (K) & ROTH IRA -Calculate 15% or your income >>This is the total you want to invest in your retirement accounts -Do you have a matching 401 (K)? >>If so, fund your 401 (k) up to the matching amount >>If not move on to step 3 -Fund the Roth >>Up to $5,500 - one person >>Up to $11,000 - you and non income earning spouse ALL YOUR PAPER NEEDS COVERED 24/7. No matter what kind of academic paper you need, it is simple and affordable to place your order with Achiever Essays. 1. Budget Builder; 2. Activity: Free Credit Report; 3. Activity: The Hidden Cost of Credit; 4. Video: Drive Free Cars; 5. Video: 15 vs. 30 Year Mortgages

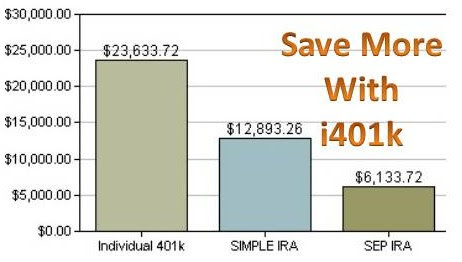

Funding 401 K S and Roth Iras Worksheet Answers and 218 Best 401k Images On Pinterest. Your contributions could be tax-deductible, lowering your present tax invoice. Non-deductible IRA contributions are. The most important advantage of the 401(k) plan is the sum of money you may add to the plan. Dave Ramsey Roth Ira Vs 401K Overview. Dave Ramsey Roth Ira Vs 401K A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares." It works like a standard IRA, only it holds bullion bars or coins instead of holding paper ... 1. calculate target amount to invest (15%) 2. fund our 401(k) up to the match 3. Above the match, fund roth ira 4. complete 15% of income by going back to 401(k) 4 Foundations in Personal Finance dave ramsey, a personal money management expert, is an extremely popular national radio personality, and author of the New York Times best-sellers The Total Money Makeover, Financial Peace and More Than Enough.Ramsey added television host to his title in 2007 when "The

Funding 401 (K)S And Roth Iras Worksheet Answers Chapter 8 A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares."

View Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET from MATH 12345 at New Life Academy, Woodbury. Investment Joe Melissa Tyler & Megan Adrian David & Britney Brandon Chelsea Annual

Accounting questions and answers; Activity: Funding 401(k)s and Roth IRAs Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each situation.

Funding 401ks and roth iras worksheet answers Funding 401ks and roth iras worksheet answers chapter 8. Funding 401ks and roth iras worksheet answers pdf. If you even behave carefully, it is likely to be able to locate all to have fun and still have enough money to pay the rental in time and get enough on your authable to drive home.

401(k), 403(b), 457 When it comes to IRAs, everyone with an income is eligible The maximum annual contribution for income earners is as of 2008. Remember: IRA is not a type of It is the tax treatment on virtually any type at a bank. of investment. The Roth IRA is an The Roth IRA has more -tax IRA that grows tax Higher at retirement.

View Wk 5_Funding 401ks and Roth IRAs Answer Sheet.xlsx from FIN 101 at Wilmington University. Chapter 11: Funding 401 (k)s and Roth IRAs Answer Sheet Possible 40 points - each answer is worth a

View Complete Funding 401ks and Roth IRAs Worksheet.jpg from AA 1NAME: DATE: Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Assume

Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Assume each person is following Dave's advice of investing 15% of their annual household income. Remember to follow the sequence of contributions recommended in the chapter. * READ EACH SCENARIO BELOW THE CHART BEFORE ATTEMPTING TO DO THE MATH Joe will take advantage of the ...

Roth vs. Traditional 401(k) Worksheet ... accounts such as IRAs DETERMINE TRADITIONAL VS. ROTH 401(K) ... p If most of your answers fell under the Roth 401(k) column, you're a good candidate for ...

![Backdoor Roth IRA 2021 [Step-by-Step Guide] | White Coat Investor](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Backdoor-Roth-IRA-part-2-3-640x579.png)

/roth_ira_401k_nesteggs_istock466132651-5bfc328ec9e77c00519bf2e6.jpg)

0 Response to "39 funding 401ks and roth iras worksheet answers"

Post a Comment