38 income tax organizer worksheet

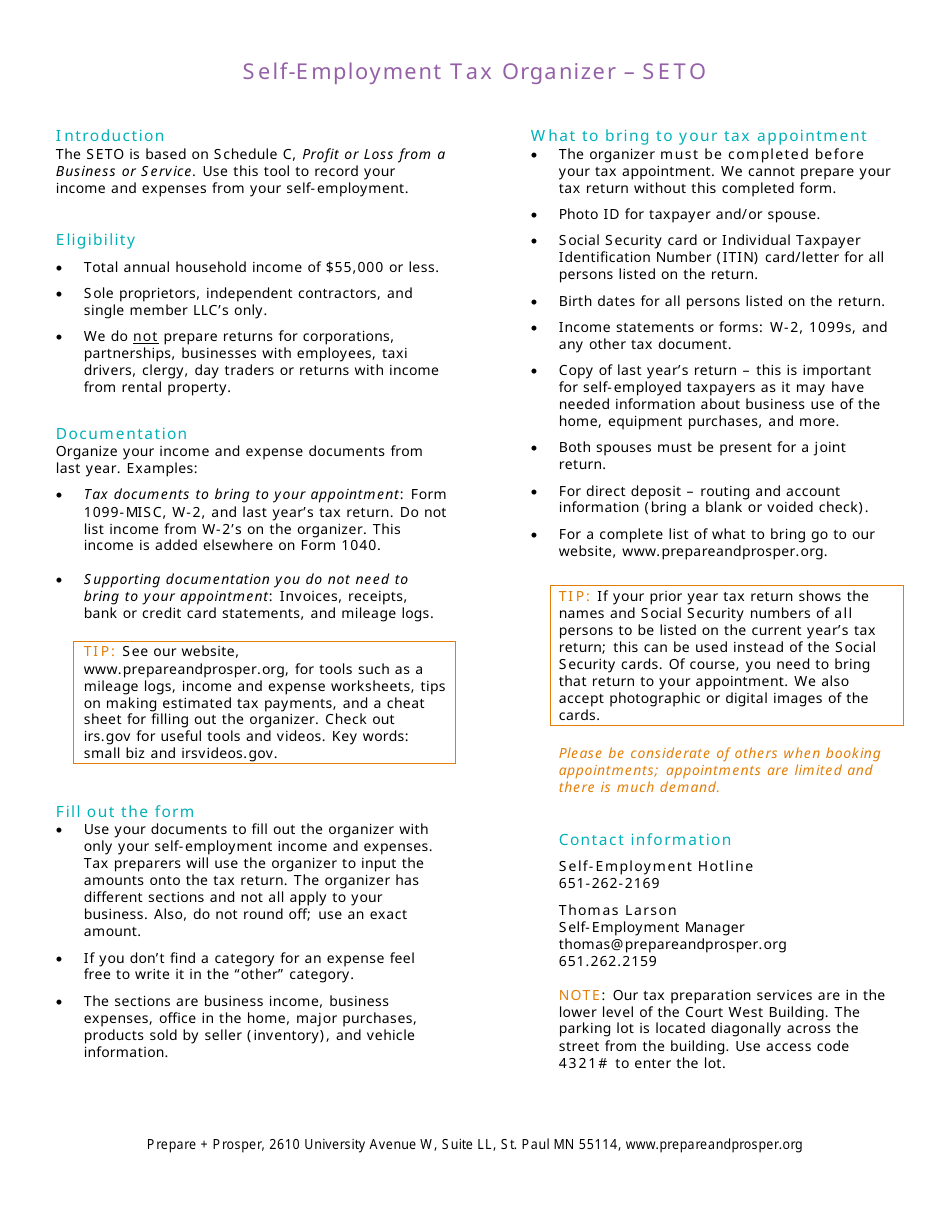

•You pay SE tax if net earnings from self-employment were $400 or more ï The SE tax ules r apply no matter how old you are and even if you are 1already receiving Social Security or Medicare benefits. •Currently the maximum 15.3% rate is on the first $132,900 of net self employment income. The Self‐Employed Tax Organizer should be completed by all sole proprietors or single member LLC owners. It has been designed to help collect and organize the information that we will need to prepare the business portion of your income tax returns in the most efficient and timely manner possible.

Tax Organizer ORG0 A copy of your tax return (if not in our possession). Original Form(s) W-2. Copies of other compensation or pension documentation, such as Form 1099-MISC, Form 1099-R, or Form 1099-NEC. Form(s) 1099 or statements reporting dividend and interest income. Brokerage statements showing transactions for stocks, bonds, etc.

Income tax organizer worksheet

2021 INCOME TAX ORGANIZER Social Security Number Social Security Number e-mail address Work Phone Blind? Blind? Taxpayer's Name Spouse's Name Taxpayer's Occupation Spouse's Occupation State Zip Date of Birth (DOB.) Date of Birth (DOB.) Home Phone Address City 1) Name 3) Name 1) Name 2) Name THINGS TO BRING (if applicable): NOTE: If you claim the earned income credit, please provide proof that your child is a resident of the United States. This proof is typically in the form of: school records or statement, landlord or property management statement, health care provider statement, medical records, child care provider H&R Block has been approved by the California Tax Education Council to offer The H&R Block Income Tax Course, CTEC# 1040-QE-2355, which fulfills the 60-hour "qualifying education" requirement imposed by the State of California to become a tax preparer. A listing of additional requirements to register as a tax preparer may be obtained by ...

Income tax organizer worksheet. To the best of my knowledge the information enclosed in this client tax organizer is correct and includes all income, deductions, and other information necessary for the preparation of this year's income tax returns for which I have adequate records. Taxpayer Date Spouse Date CTORG06 01-21-22 Human migration involves the movement of people from one place to another with intentions of settling, permanently or temporarily, at a new location (geographic region). The movement often occurs over long distances and from one country to another, but internal migration (within a single country) is also possible; indeed, this is the dominant form of human migration globally. Retail Food Established Computation Worksheet for Sales Tax Deduction For Gas and/or ... The retailer must either file a separate return for their sales at the special event or remit the tax for such sales to the event organizer, ... the sales taxes are based on the book value set up by the purchaser for income tax depreciation ... ESTATE PLANNING WORKSHEET . USING THIS ORGANIZER WILL ASSIST US IN DESIGNING . A PLAN THAT MEETS YOUR GOALS. ALL INFORMATION PROVIDED IS STRICTLY CONFIDENTIAL . For efficiency in planning, please bring with you each of the following: ♦ Any existing Wills and Codicils, Trusts, and other estate planning documents. ♦ …

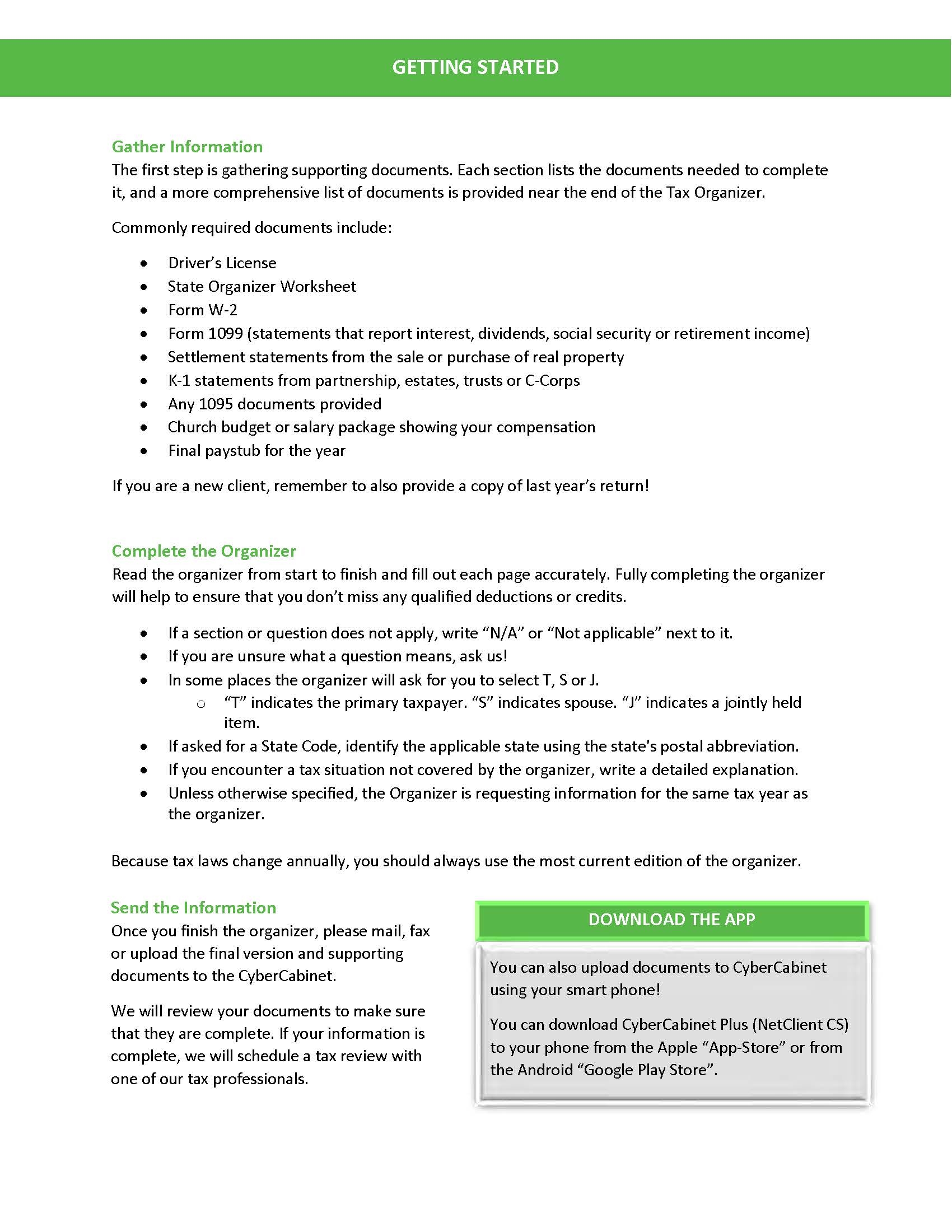

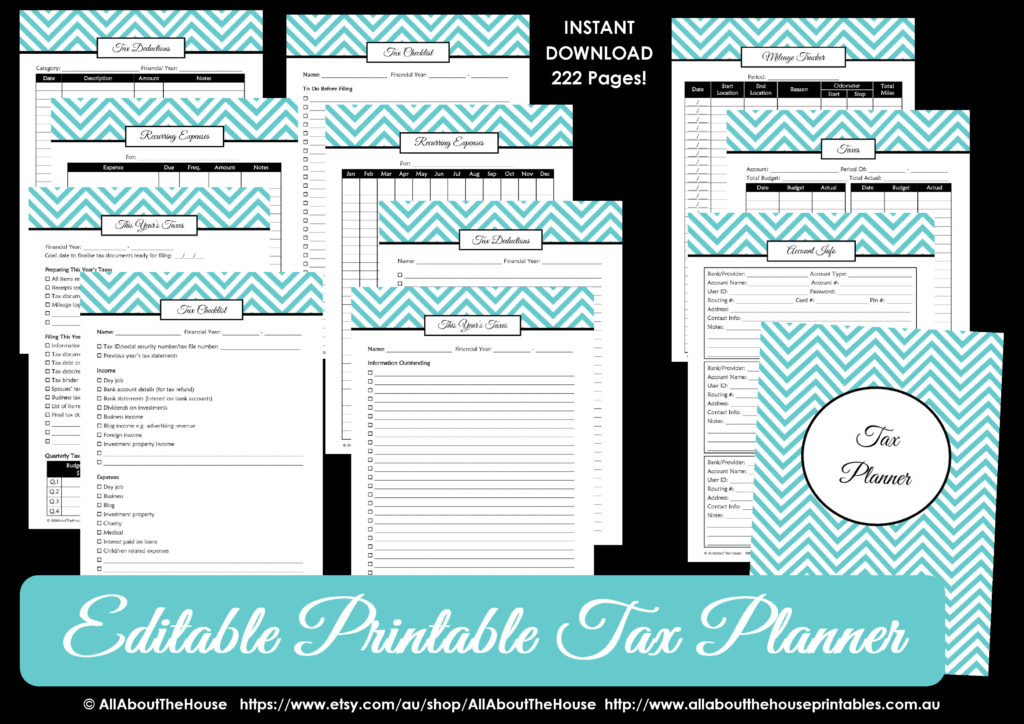

Click on the "View Tax Organizer" button below to bring up the organizer in a new window. 2. Print the organizer by clicking on the printer icon on the top of the screen. 3. Fill out all the information you can. 4. Call us and schedule a meeting. 5. Bring the completed tax organizer and all supporting documents to the meeting. Andrew File System (AFS) ended service on January 1, 2021. AFS was a file system and sharing platform that allowed users to access and distribute stored content. AFS was available at afs.msu.edu an… 2021 Tax Organizer (Fillable) Our Complete Tax Organizer asks questions required for accurate preparation of your 2020 individual tax return. Please use the additional pages below as needed. Don't forget to save the PDF to your desktop before filling it in! 17.11.2016 · Bookkeeping, accounting, tax preparation. Fun, fun fun.. not! Unfortunately it’s an unavoidable part of doing business 🙁 I originally used my Etsy Business Planner to keep track of income, expenses, fees, payments, bills etc. but when I hired an accountant a few years ago, they wanted everything digital not pen and paper. So I created some spreadsheets to help me …

If you miss an important form on your tax return, such as income or deduction form, you will have to prepare a tax amendment. In order to avoid the hassles of a tax amendment, we at eFile.com strongly recommend to not e-file your 2021 Taxes before February 1, 2022. This is for the simple reason that all 2021 Forms need to be mailed to you ... Income Tax Organizer. Here are a number of highest rated Income Tax Organizer pictures on internet. We identified it from honorable source. Its submitted by paperwork in the best field. We acknowledge this nice of Income Tax Organizer graphic could possibly be the most trending subject behind we allowance it in google pro or facebook. Tax deferral can have a dramatic effect on the growth of an investment. Use this calculator to determine the future value of a fixed interest investment being subject to income tax each year versus deferring the tax until withdrawal. 1099-G forms for unemployment income, or state or local tax refunds SSA-1099 for Social Security benefits received 1099-R, Form 8606 for payments/distributions from IRAs or retirement plans 1099-INT, -DIV, -B, or K-1s for investment or interest income Most people will need: 1099-S forms for income from sale of a property

Jan 10, 2022 · Tax Sheets; 1099 Information Sheet: Farmer Tax Worksheet: Microsoft Word version: Farmer Tax Worksheet: PDF version: Individual Income Tax Organizer: Printable or Fillable Word Document: Individual Income Tax Organizer: Printable or Fillable PDF Document: W-2 Reporting Information: W-2 Worksheet Nothing contained on this website constitutes tax, accounting, regulatory, legal, insurance or ...

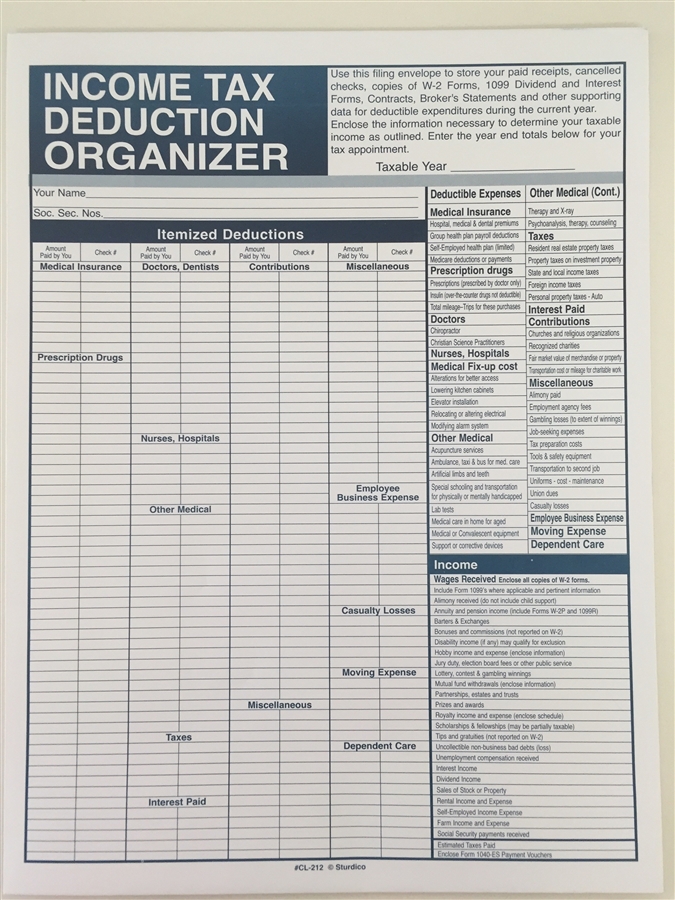

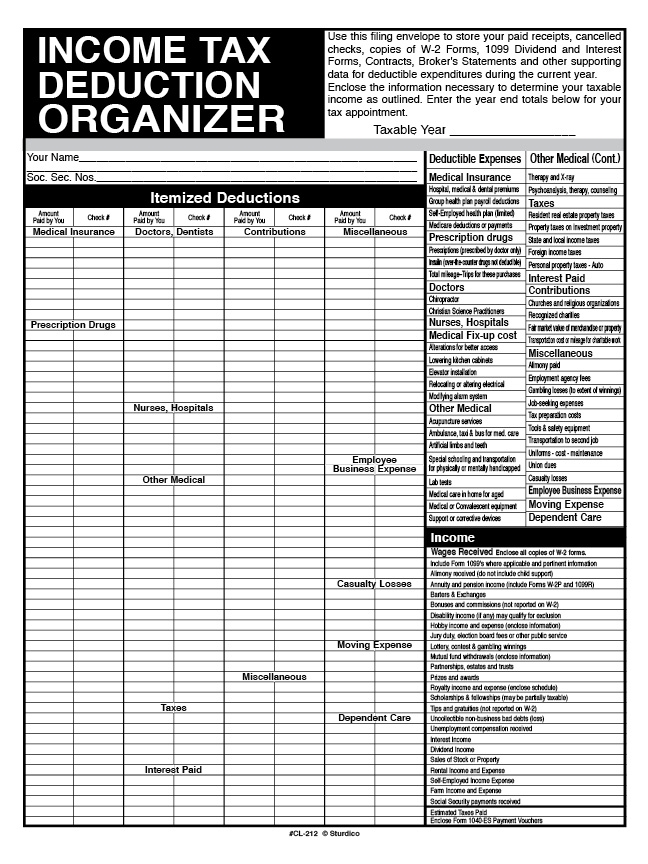

Income Tax Organizer Worksheet. All the information needed printed on one user-friendly 8 1/2 x 11" sheet. Simple & easy for clients. Download Now. Want printed copies? Let us do your printing for you. Call 612-722-3552 for a quote. Active subscribers get 20% off of our competitive rates. Imprints and custom orders are available too.

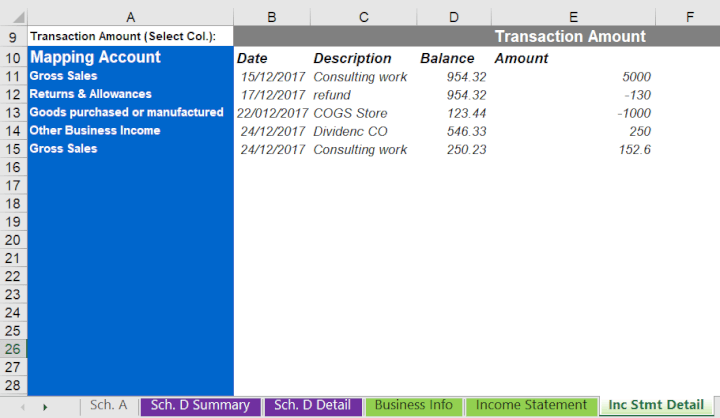

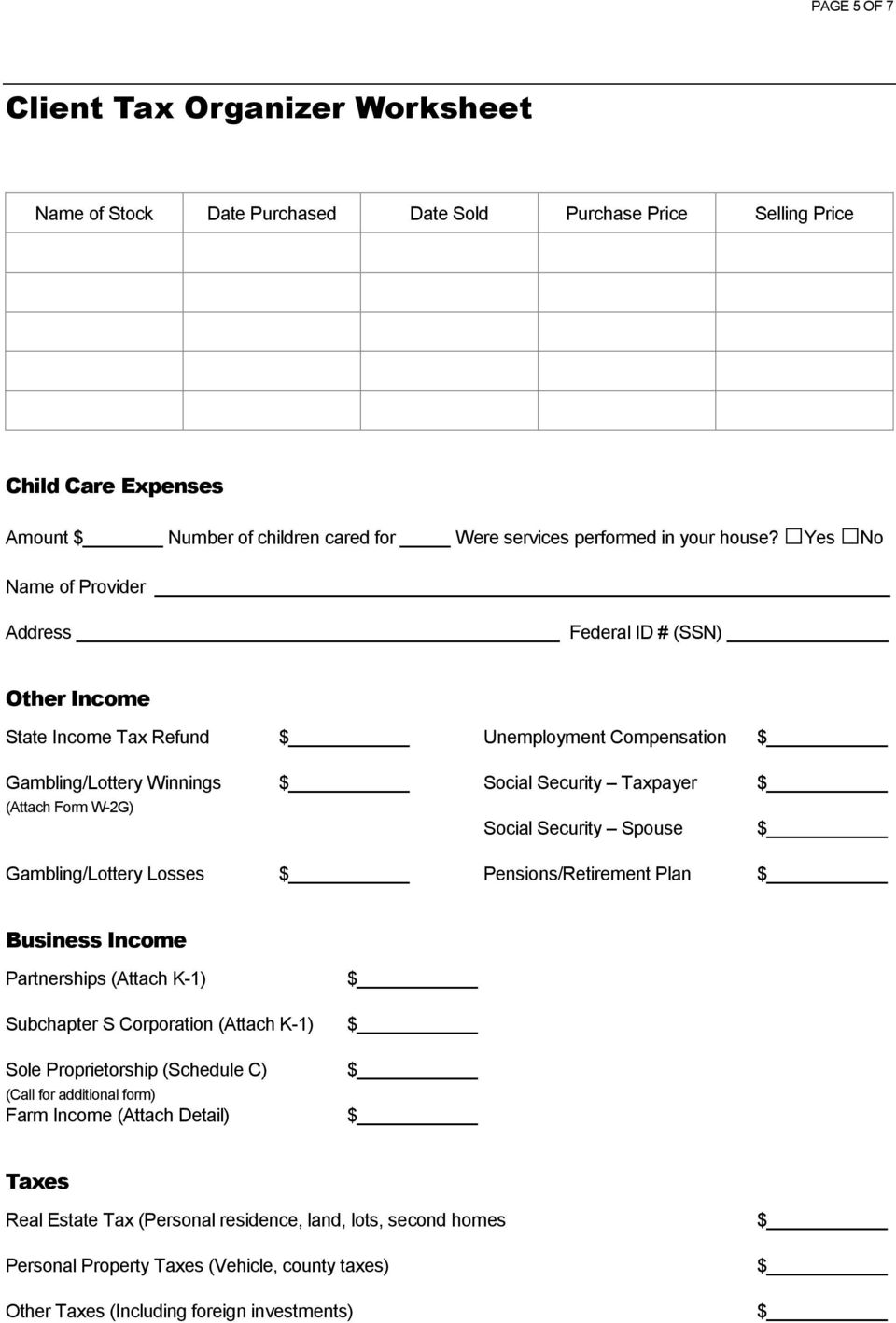

This tax organizer will assist you in gathering information necessary for the preparation ... 1040 US Business Income (Schedule C) 16 16 ORGANIZER Series: 51 No.

Downloadable tax organizer worksheets FREE income tax organnizers and data worksheets to help you plan and preparer your Federal and state income taxes. FileTax offers free tax forms and information. Donate your glasses. someone in the world gets to see the world in focus again. Cashback Planet offers coupons, promotions, and

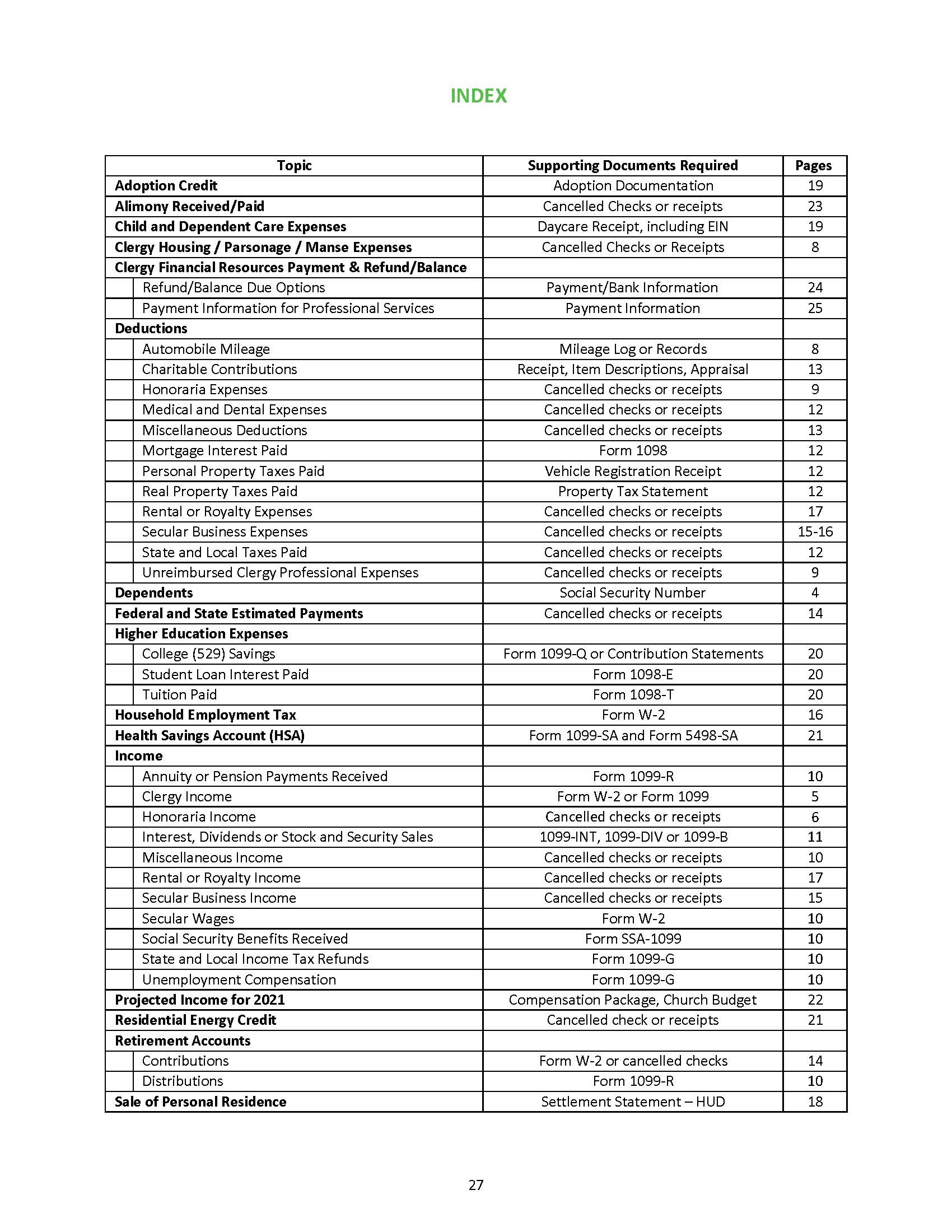

The following checklists, organizers and worksheets are designed to help you organize your tax documents so that I can prepare a complete and accurate income tax return for you. They are not mandatory, simply a guide to help you organize your tax information. The Long Form Tax Organizer tab (listed above) is a more complex checklist.

TAX TRACKING WORKSHEET MARY KAY INCOME & EXPENSES. ccounting nlimited Name SPECIALIZING IN SMALL BUSINESSES & TAXES Year If this is your first year - Give Start Date MARY KAY WORKSHEET THIS IS AN INFORMATION WORKSHEET FOR OUR CLIENTS CALL IF YOU HAVE QUESTIONS. Prizes

Are you interested in Section 179 to expense capital purchases this year to reduce tax if possible? _____ YES _____ NO Are you interested in using Farm Income Averaging if possible to reduce current tax liability? _____ YES _____ NO If you have a net operating loss on the farm, would you like to pay Optional Self-Employment taxes?

income tax returns. Where indicated, we have provided additional worksheets and other specialized organizers where you can provide additional important information. Please provide us with a copy of the corporation's tax returns for the past 3 years if you are a first-time client of Pacific Northwest Tax Service.

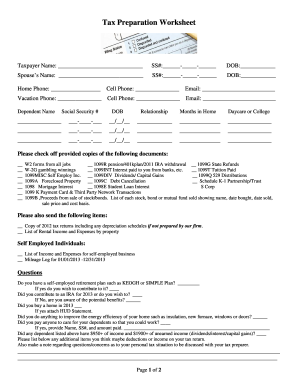

2021 TAX PREPARATION WORKSHEET ... For a worksheet containing your prior year amounts, call or email and we can send you a personalized organizer based on your last year’s return. WHAT TO SEND Your ... • All income forms, including W‐2, 1099‐R/SSA/RRB, 1099‐INT/DIV, and 1099‐B (brokerage)

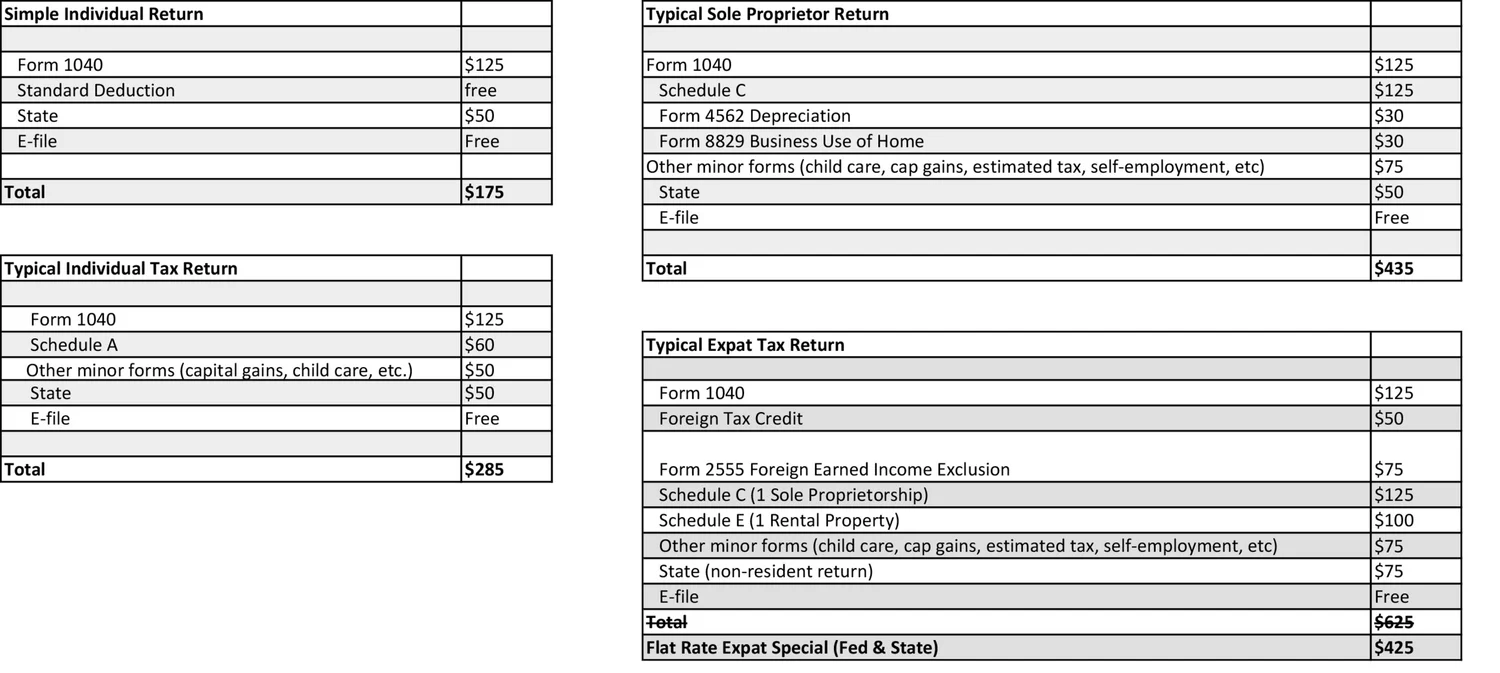

Tax Preparation Organizer. Here are a number of highest rated Tax Preparation Organizer pictures upon internet. We identified it from reliable source. Its submitted by paperwork in the best field. We tolerate this nice of Tax Preparation Organizer graphic could possibly be the most trending subject later we allowance it in google lead or facebook.

Tax Sheets; 1099 Information Sheet: Farmer Tax Worksheet: Microsoft Word version: Farmer Tax Worksheet: PDF version: Individual Income Tax Organizer: Printable or Fillable Word Document: Individual Income Tax Organizer: Printable or Fillable PDF Document: W-2 Reporting Information: W-2 Worksheet

Itemized Deductions Worksheet Deductions must exceed $12,000 Single or MFS, $18,000 HOH, or $24,000 MFJ to be a tax benefit. Medical Expenses. Must Ifexceed 7.5% of income to be a benefit— include cost for dependents — do not include any expenses that were

The organizer covers income, deductions, and credits, and will help in the preparation of your tax return by focusing attention on your specific needs. Please enter your 2019 information in the designated areas on the worksheets.If you need to include additional information,

With that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and 20% toward ...

Please send us all your 1099-Bs and associated reports to enable us to fill out this organizer. Excel 1099-R Retirement Income If you receive two or more 1099-Rs, please print out this sheet and fill it in. Enter all your retirement income: IRA, SEP, 401 (k) or Pension Plans and attach your 1099-Rs and 5498s for your records. (One page).

Click on the "View Tax Organizer" button below to bring up the organizer in a new window. 2. Print the organizer by clicking on the printer icon on the top of the screen. 3. Fill out all the information you can. 4. Call us and schedule a meeting. 5. Bring the completed tax organizer and all supporting documents to the meeting.

13 best images of monthly income expense worksheet. Tax Organizer Sheet Free. Here are a number of highest rated Tax Organizer Sheet Free pictures upon internet. ... We believe this kind of Tax Organizer Sheet Free graphic could possibly be the most trending subject subsequently we portion it in google pro or facebook.

A tax organizer is a client-facing document to help with the collection and submission of client information necessary to prepare a tax return. The individual income tax return organizer should be used with the preparation of Form 1040, U.S. Individual Income Tax Return. Provide it to your client to get started with tax planning and preparation.

Income Worksheet. Provide to your preparer all Forms W-2, 1099-INT, 1099-DIV, 1099-R, 1099-MISC, 1099-NEC, and other income reporting statements. Do not list dollar amounts for the following forms. Your preparer will report the appropriate amounts.

While we talk about Tax Preparation Organizer Worksheet, below we will see several related images to complete your ideas. business income expense spreadsheet template, tax deduction worksheet and 2014 tax organizer worksheet are some main things we will show you based on the gallery title.

Need Help? Call (612) 722-3552. Login. Username; Password Remember me Not Registered?

Alliance Financial & Income Tax. Office: (816) 220-2001. Fax: (816) 220-2012

Remember for 2022, if no federal income tax is withheld from unemployment payments, it could mean an estimated tax payment should be made. For more information, review Tax Topic 418, Unemployment Compensation and Publication 525, Taxable and Nontaxable Income , on IRS.gov.

H&R Block has been approved by the California Tax Education Council to offer The H&R Block Income Tax Course, CTEC# 1040-QE-2355, which fulfills the 60-hour "qualifying education" requirement imposed by the State of California to become a tax preparer. A listing of additional requirements to register as a tax preparer may be obtained by ...

NOTE: If you claim the earned income credit, please provide proof that your child is a resident of the United States. This proof is typically in the form of: school records or statement, landlord or property management statement, health care provider statement, medical records, child care provider

Smead All-in-Oneâ„¢ Income Tax Organizer with Flap and Cord Closure, 13 Pockets, Letter Size, Blue/White (70660)

2021 INCOME TAX ORGANIZER Social Security Number Social Security Number e-mail address Work Phone Blind? Blind? Taxpayer's Name Spouse's Name Taxpayer's Occupation Spouse's Occupation State Zip Date of Birth (DOB.) Date of Birth (DOB.) Home Phone Address City 1) Name 3) Name 1) Name 2) Name THINGS TO BRING (if applicable):

0 Response to "38 income tax organizer worksheet"

Post a Comment